The football season in America starts this month, with the NFL regular season kicking off. Sports betting is reaching unprecedented heights after legalization. NFL sports betting is forecasted to reach almost $24 billion during the 2023-24 season.

Popular sports betting and gaming technologies operator DraftKings Inc. (DKNG) stands to profit from the NFL season. However, the company also faces rising competition in the sports betting market.

Recently, renowned sports network ESPN announced a $2 billion deal with a gaming company, Penn Entertainment, to launch a sportsbook called ESPN Bet. The entry of the sports broadcasting juggernaut into the betting market could usher in a significant change in the market.

DKNG is doubling down on its marketing efforts through the planned launch of a new marketing campaign featuring comedian Kevin Hart and former NFL quarterback Ryan Fitzpatrick in the face of greater competition.

Given this backdrop, let’s look at the trends of DKNG’s key financial metrics to understand why it could be wise to avoid the stock now.

DKNG Financial Trends: An Analysis of Net Income and Other Key Indicators

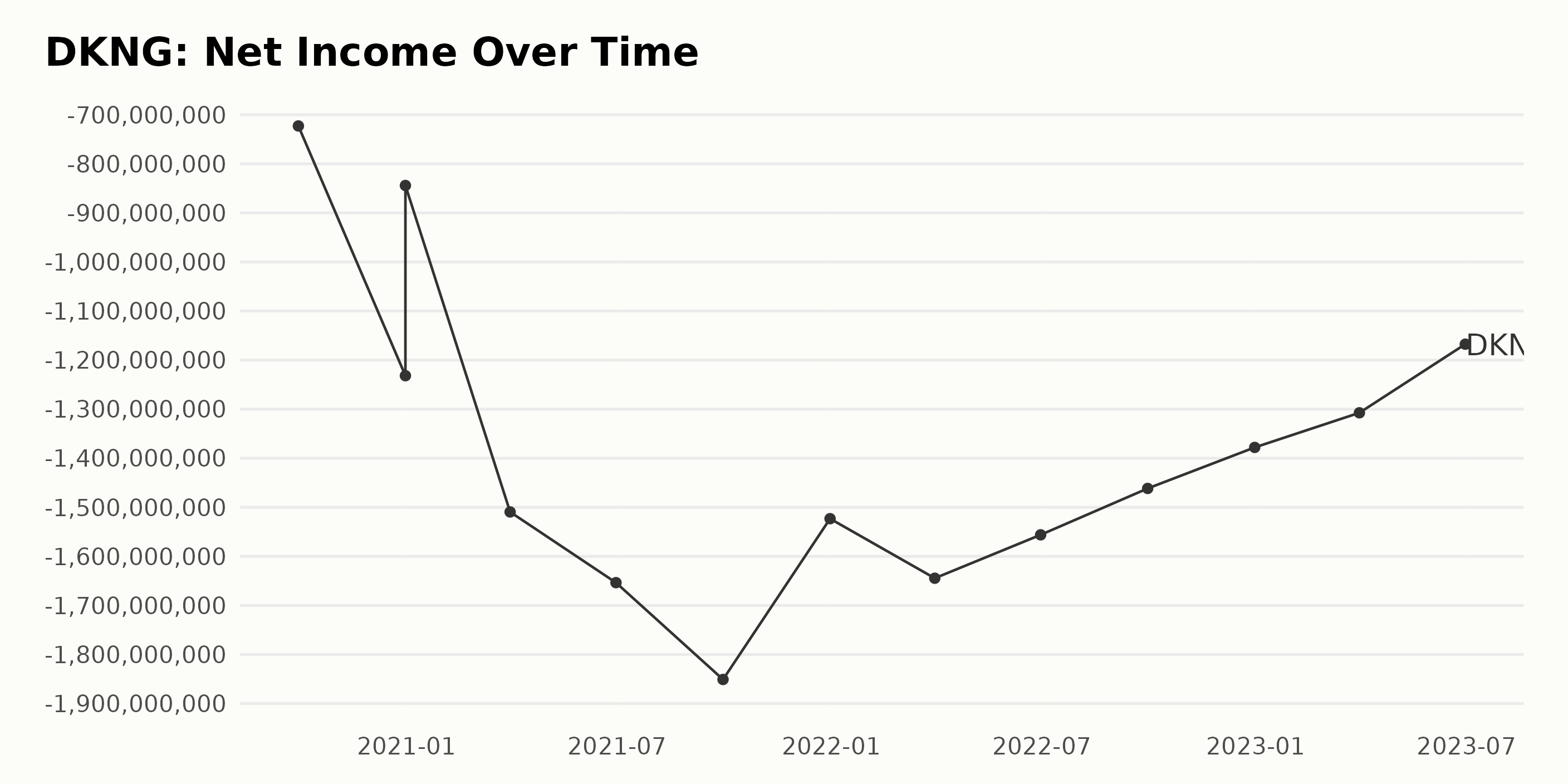

The trailing-12-month net income reported by DKNG demonstrates some fluctuations but an overall decrease or negative growth over the years.

- On September 30, 2020, the net income was -$722.94 million.

- A sudden drop was observed at the end of that year on December 31, with a net income value of -$1.23 billion, which is an erroneous duplication with a correct value of -$844.27 million.

- The first quarter of 2021 noted even larger losses as net income plunged to -$1.51 billion.

- This trend continued as net income further decreased to -$1.65 billion by the end of the second quarter (June 2021).

- The losses went on mounting and reached -$1.85 billion by the third quarter's end (September 2021), being the largest loss in the series.

- Thereafter, a gradual uptick was observed for the next few quarters. The net income was -$1.52 billion at the end of 2021 and showed a slight increase to -$1.64 billion by the end of the first quarter in 2022.

- The losses steadily decreased over the following quarters in 2022: -$1.56 billion in June, -$1.46 billion in September, and -$1.38 billion in December.

- The marginally improved trend appears to continue into the first half of 2023, with the net income standing at -$1.31 billion in March and further decreasing losses of -$1.17 billion in June 2023.

DKNG's net income reflects a clear overarching pattern of financial losses over the period. Although it seems to follow a somewhat cyclical pattern with larger losses at the start and end of the year. Despite the ongoing trend of declining losses, the growth rate from September 2020 to June 2023 is still negative, indicating a substantial shrinkage in net income over time.

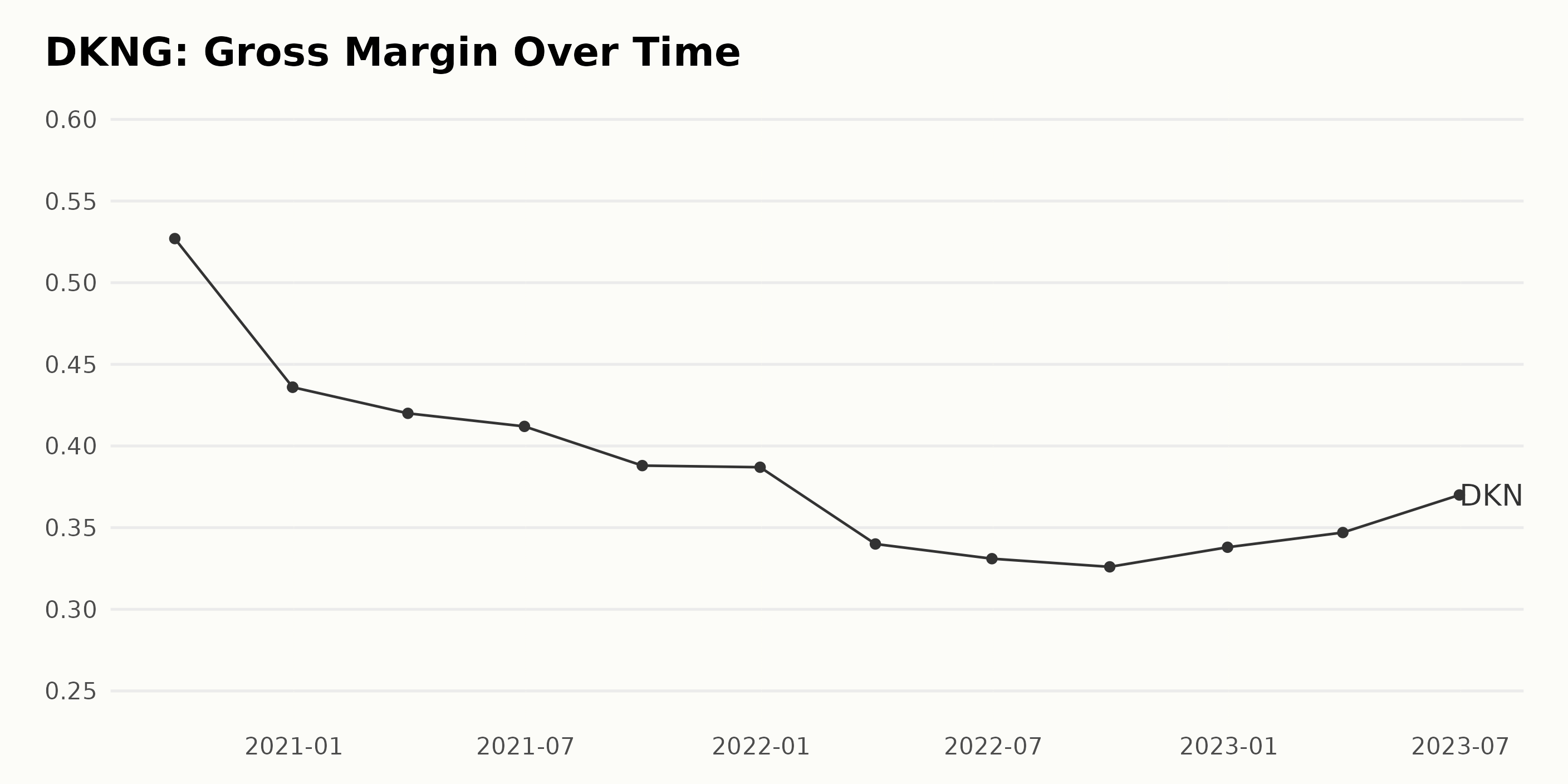

The gross margin of DKNG, has shown a fluctuating trend from September 2020 up until June 2023.

- Starting at 52.7% in September 2020, DKNG exhibited a decreasing margin trend until March 2022.

- The lowest gross margin point was recorded in September 2022, standing at 32.6%.

- An upward trend was initiated from December 2022 onwards, with the margin growing to 37.0% as per the latest figures from June 2023.

To summarize, the overall gross margin for DKNG declined by about 15% since the start of the measurements, reaching its lowest figure in September 2022. However, starting from December 2022, the gross margin started showing signs of recovery, making a rebound of around 4.4% until June 2023.

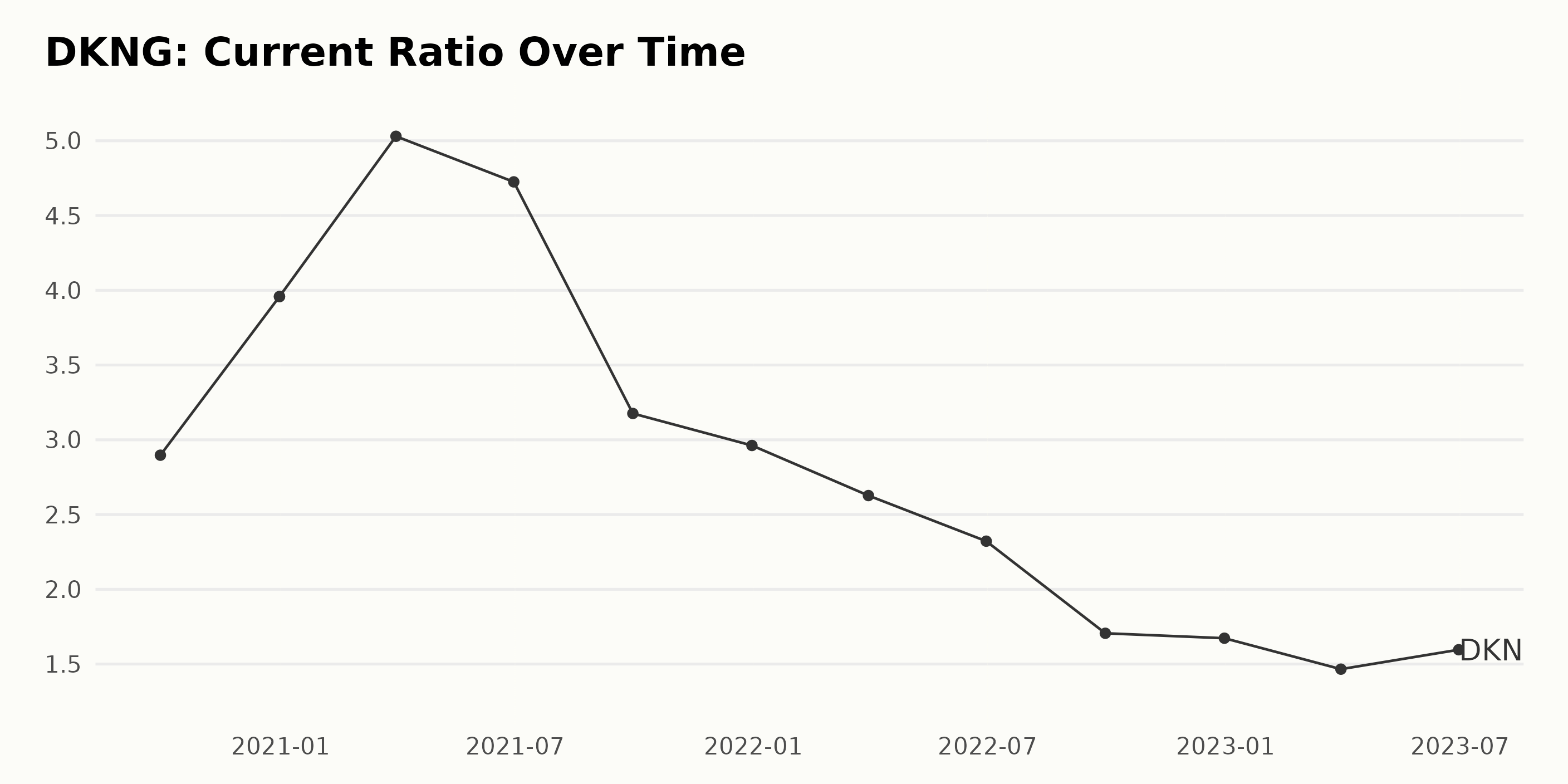

The current ratio of DKNG showed significant fluctuations over the observed period from September 2020 to June 2023. Key observations:

- Starting at 2.90 in September 2020, the ratio experienced a rising trend through March 2021, peaking at 5.03.

- Thereafter, the ratio generally showed declining numbers. By June 2021, it dropped to 4.72, and by September 2021, it had reduced dramatically to 3.17.

- The year 2022 showed a consistent decline, with a sharp decrease occurring between June (2.32) and September (1.71) of that year.

- In the last quarters reported, the ratio attempted an upswing with a minor bounce back from 1.47 in March 2023 to 1.60 in June 2023.

The most recent current ratio value for DKNG stands at 1.60 in June 2023, which marks a decrease of approximately 45% compared to the initial reported value in September 2020. This suggests that the company's liquidity position has been weakening throughout this period.

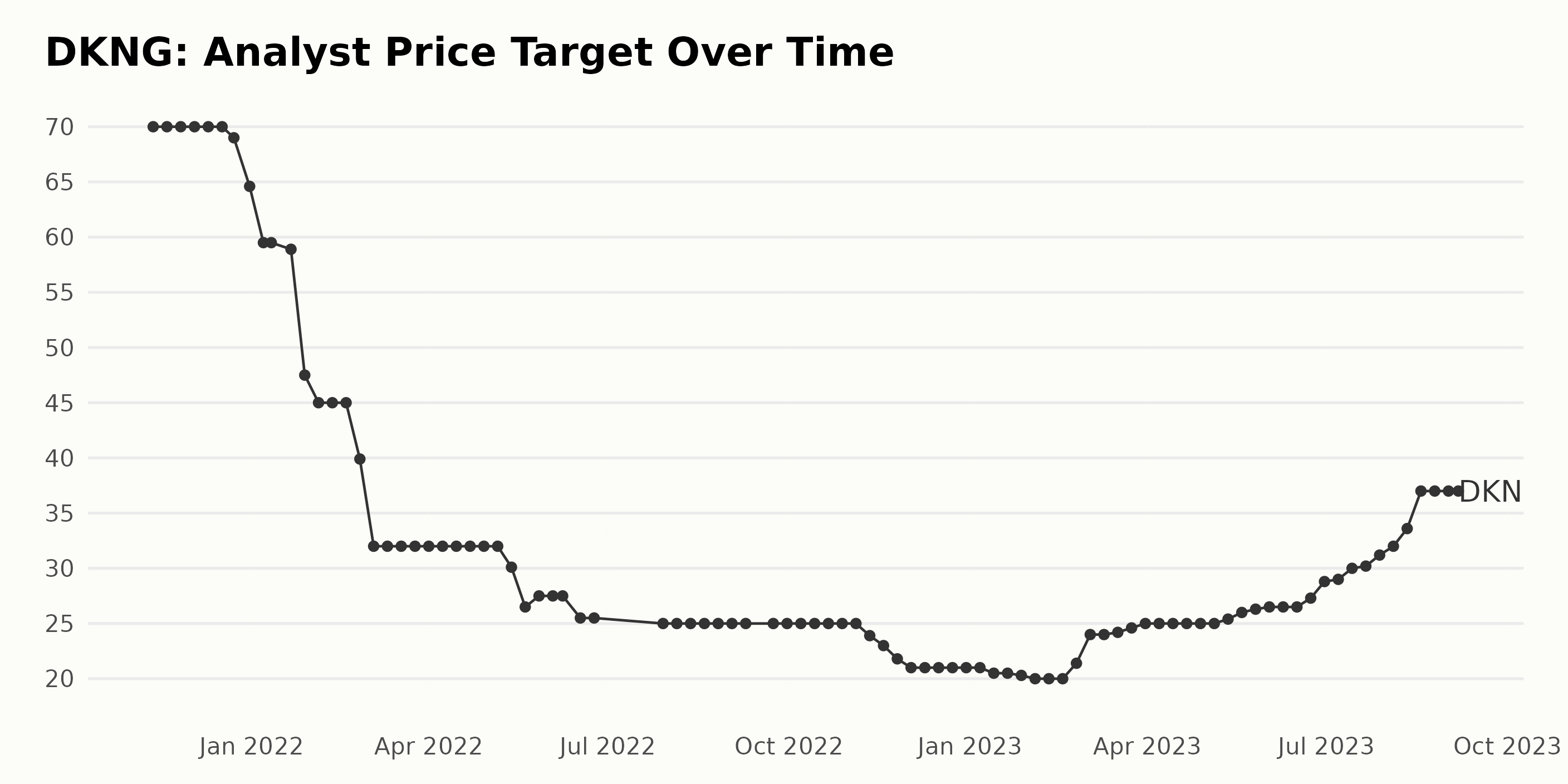

Analyzing the data trends and fluctuations with respect to DKNG's analyst price target:

- Starting from November 12, 2021, the analyst price target for DKNG initially remained stable at $70 before witnessing a downward trend beginning in late December 2021.

- By the end of December 2022, the analyst price target had reduced to $21, marking a significant decline over the course of the year.

- From the start of January 2023 to mid-March 2023, there was a slight fluctuation, with the price target dipping as low as $20. However, a turnaround was observed by the end of February end, with the price target increasing gradually.

- Notably, this upward growth trend continued throughout the subsequent months into August 2023, when the analyst price target reached $37.

- The most recent data point available, from September 6, 2023, displays an analyst price target of $37, maintaining the increased level achieved in August 2023.

The growth rate, measured by comparing the final value with the first, shows an approximately -47% decrease. Despite this overall decrease, the later part of the data series from February 2023 through September 2023 shows a positive growth of about 85%.

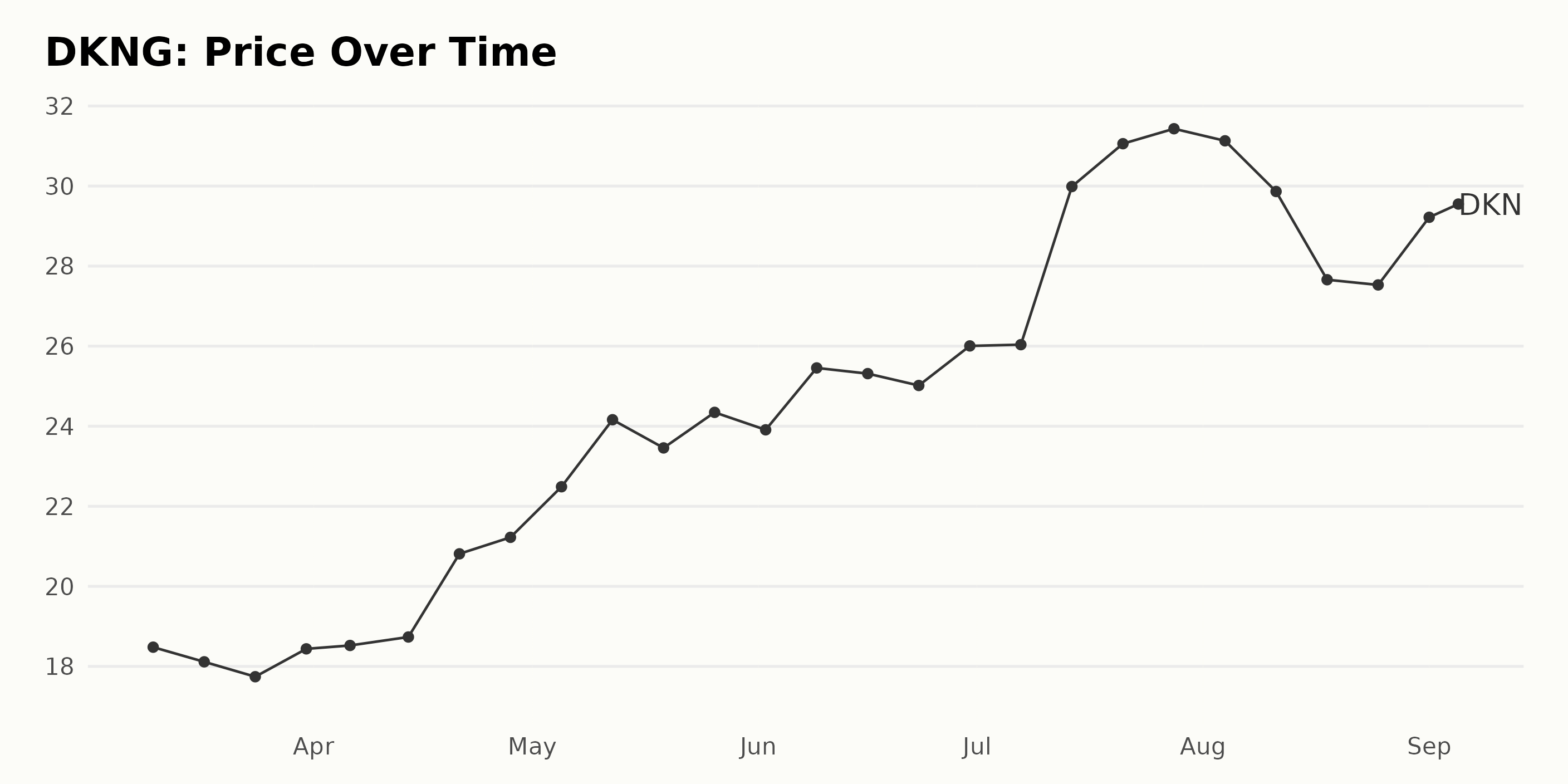

Analyzing DKNG's Stock Trend Fluctuations from March to September 2023

An analysis of the DKNG price dataset shows:

- As of March 10, 2023, the share price stood at $18.48.

- A slight dip was observed in the following two weeks, leading down to $17.74 on March 24. Thereafter, prices surged to $18.44 by the end of March 2023.

- The positive momentum carried over to April, where it rose from $18.52 in the first week to $21.22 by the end of the month.

- This upward trend escalated rapidly in May, with the price increasing to $23.46 on May 19 and closing the month at $24.35, marking a significant increase over the month.

- The monthly average growth slowed down in June, where it fluctuated around the mid $25 mark before spiking up to $26.00 at the end of the month.

- A robust growth phase was observed from the start of July, accelerating through the month, breaking the $30 mark on July 21, and reaching an even higher price of $31.43 at the end of the month.

- In contrast, August marked a downtrend, with prices starting off at $31.13, falling mid-month to $27.66, with a slight recovery to $29.55 by the beginning of September. It closed the last trading session at $29.75.

Overall, the price data of DKNG exhibits a general increasing trend from March to July 2023, followed by a decelerating trend in August, but picks up again in early September. The growth rate is variable and not steady, reflecting both periods of rapid increases and others of decline. Here is a chart of DKNG's price over the past 180 days.

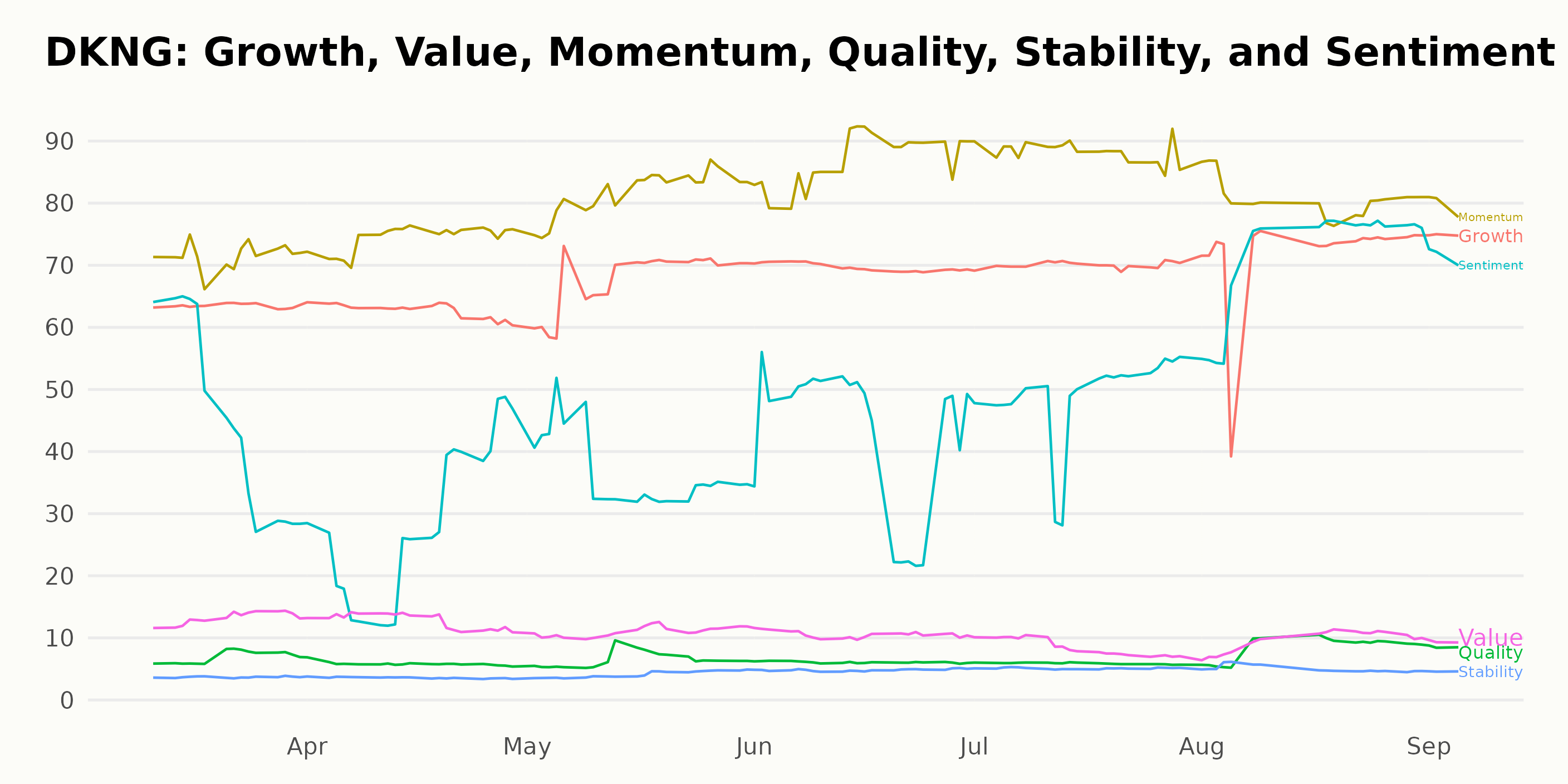

Analyzing DKNG's Growth, Momentum, and Investor Sentiment: A POWR Ratings Overview

DKNG, which falls under the Entertainment - Casinos/Gambling category of stocks, has been maintaining a consistent POWR Ratings grade of D (Sell) for several weeks. Here's an overview based on the latest data available:

- As of the week of September 6, 2023, DKNG retained a POWR grade of D (Sell).

- In terms of rank within its category, it holds the #27 spot out of 28 total stocks. Throughout this period, we've noticed fluctuations in its ranking within the category. For instance, DKNG held the #24 position in the week of August 9, 2023, but it dropped back to the #27 spot by September.

- Despite these changes, one constant factor across all these weeks is the D (Sell) POWR grade. In summary, while DKNG's rank within its category has seen slight fluctuations, its POWR grade has remained consistently at D (Sell).

Based on the POWR Ratings for DKNG across different dimensions, the three most noteworthy dimensions are Growth, Momentum, and Sentiment. Over time, these dimensions have shown substantial scores and noticeable trends.

Growth: The Growth dimension for DKNG, which signifies the expected earnings growth or revenue growth, has been high and consistently trending upward. It was valued at 63 in March 2023 and increased gradually over the months to reach a score of 75 by September 2023.

Momentum: Momentum refers to the speed or velocity of price change. For DKNG, this dimension started with a value of 72 in March 2023 and exhibited an upward trend, reaching a peak of 88 in July 2023. Thereafter, it slightly fluctuated and stood at 80 as of September 2023.

Sentiment: As for the Sentiment dimension, which may indicate the mood of investors towards DKNG, there's been a notable progression. It commenced from a relatively moderate value of 45 in March 2023 and experienced variances over time, with a significant uplift to a high of 72 by September of the same year.

How does DraftKings Inc. (DKNG) Stack Up Against its Peers?

Other stocks in the Entertainment - Casinos/Gambling sector that may be worth considering are Monarch Casino & Resort, Inc. (MCRI), Accel Entertainment, Inc. (ACEL), and Inspired Entertainment Inc. (INSE) - they have better POWR Ratings. Click here to see more Entertainment - Casinos/Gambling stocks.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

DKNG shares were trading at $30.03 per share on Wednesday afternoon, up $0.28 (+0.94%). Year-to-date, DKNG has gained 163.65%, versus a 17.02% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Is DraftKings (DKNG) a Buy in Time for Football Season? appeared first on StockNews.com