(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Stocks are literally on a see-saw. Up one day…down the next.

So after testing the recent lows once again on Monday it was a surprise to no one that we bounced Tuesday. Nor would we be shocked with a sell off to follow.

Let’s dig in a bit more with current market conditions and align our trading strategy to make the best of this trying situation.

Market Commentary

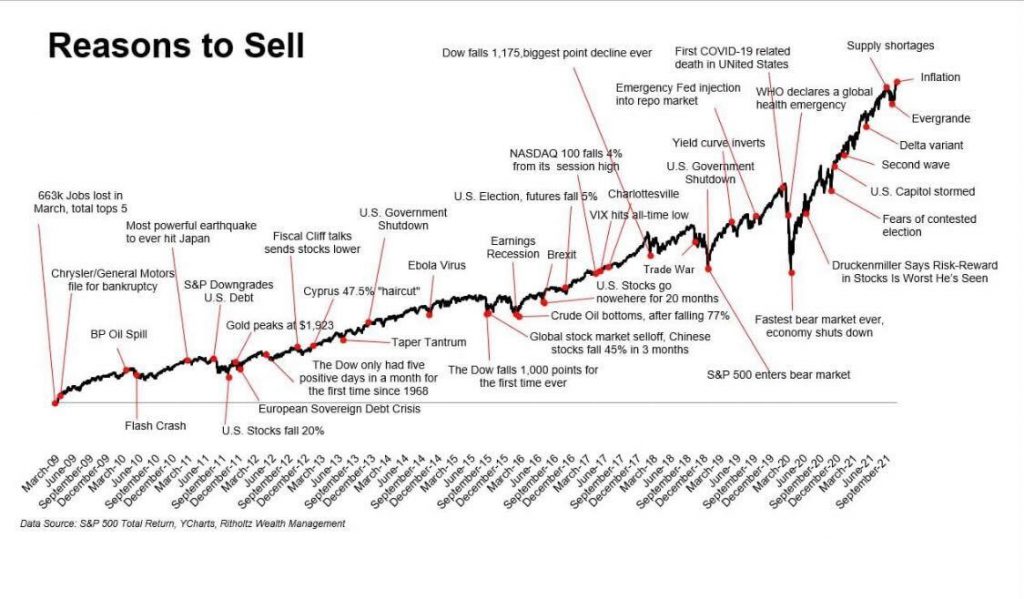

Let’s start off with this interesting chart entitled “Reasons to Sell”… but to be honest, it should end in a question mark as it points out time and time again why short term negatives that led to numerous pull back and corrections were nothing more than buy the dip opportunities.

So even though there is good reason for uncertainty at this time with a foul tasting cocktail of high inflation and Russia/Ukraine crisis, in the end I still strongly suspect this proves to be just another short term detour on a long term bullish highway. The longer version of that outlook was shared in the 3/7/21 POWR Platinum webinar.

In other interesting news we should ponder the Fed Rate decision for Wednesday afternoon. The Fed has CLEARLY signaled that a rate hike is coming and there should be no taper tantrum sell off.

Again, I say their shouldn’t be a ticker tantrum. But traders are hyperactive children jacked up on caffeine and sugar. So any reaction is possible in the short run. Over time clearer heads prevail and that is when people still realize that with rates on the rise that bonds will lose value and stocks are still much more attractive by comparison.

Yes, this is all part of the TINA argument we have discussed ad nauseum in my commentary. (TINA = There Is No Alternative…to owning Stocks). However, with 10 year Treasury rates still half of the historic norms around 4%...then it gives a strong bias to stock ownership. This concept in many ways supplies a floor under stock prices which is why I think 4,000 will prove to be an area of strong support.

However, I can also picture a scenario where investors need to push things to the brink of bear market territory. That would be a 20% drop from the all time highs down towards 3,854. That could be a quick intraday move that sparks a violent, and likely, lasting bounce.

Reity, are you saying we should be on the sidelines, or even shorting the market til we reach 3,854?

NO!!!

This is a statement of what COULD happen. The fact is that the TINA environment may lead to support at any time putting this sad correction chapter behind us.

In fact, the recent dramatic drop in oil prices also greatly eases inflation concerns, which alone could be the catalyst to get us moving back in a bullish direction.

Add it altogether and I think we are properly dialed in at 59.5% long the stock market. That is the right balance between the bullish and bearish forces at play.

If stocks retreat to 4,000, we will take profits on our 3X inverse ETF position which will push us back up to 77.5% long. That posture makes sense as a bounce should be forthcoming. The reason to not get back to 100% long is that we may test, and retest 4,000 for weeks to come. Or even press down to that extreme level of 3,854 before a true capitulation bottom can be found.

The more this correction looks to be in the rear view mirror…the more we will move towards 100% long.

However, if things do get worse with Russia/Ukraine…or inflations negative effects on the economy are more prevalent…then we will move in the other direction and get more defensive.

Yes, we all would like an absolute answer at this time, but that is not reality. The economy and its correlations to the stock market are VERY COMPLEX. There is no one on the planet that knows with absolute certainty what will happen. The best we can do is assess the odds at any moment in time. And with that nimbly recalibrate our portfolio to align with those odds.

So even though I am very confident that the bull market will return this year with new highs in hand before the year is out…I cannot guarantee that…and would be foolish to bet on that outcome until the rest of the market was in greater agreement.

Please stay open minded to the new facts as they roll in…and stay nimble to make timely trades as required.

What To Do Next?

Discover my top picks for this hectic market environment.

I am referring to the 10 stocks and 4 ETFs in my Reitmeister Total Return portfolio that firmly beat the market last year. And well ahead of the market once again in 2022.

How is that possible?

The clue is right there in the name: Reitmeister Total Return

Meaning this service was built to find positive returns in all market environments. Not just when the bull is running full steam ahead. Heck, anyone can profit in that environment.

Yet when stocks are trending sideways, or even worse, heading lower…then you need to employ a different set of strategies to be successful.

Come discover what 40 years of investing experience can do you for you.

Plus see get access to my full portfolio of 10 stocks and 4 ETFs that are primed to excel in this unique market environment.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $431.85 per share on Wednesday morning, up $5.68 (+1.33%). Year-to-date, SPY has declined -9.08%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Riding the Stock Market See-Saw appeared first on StockNews.com