Yext trades at $6.31 per share and has stayed right on track with the overall market, gaining 13.7% over the last six months. At the same time, the S&P 500 has returned 9.1%.

Is there a buying opportunity in Yext, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We're swiping left on Yext for now. Here are three reasons why we avoid YEXT and a stock we'd rather own.

Why Is Yext Not Exciting?

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

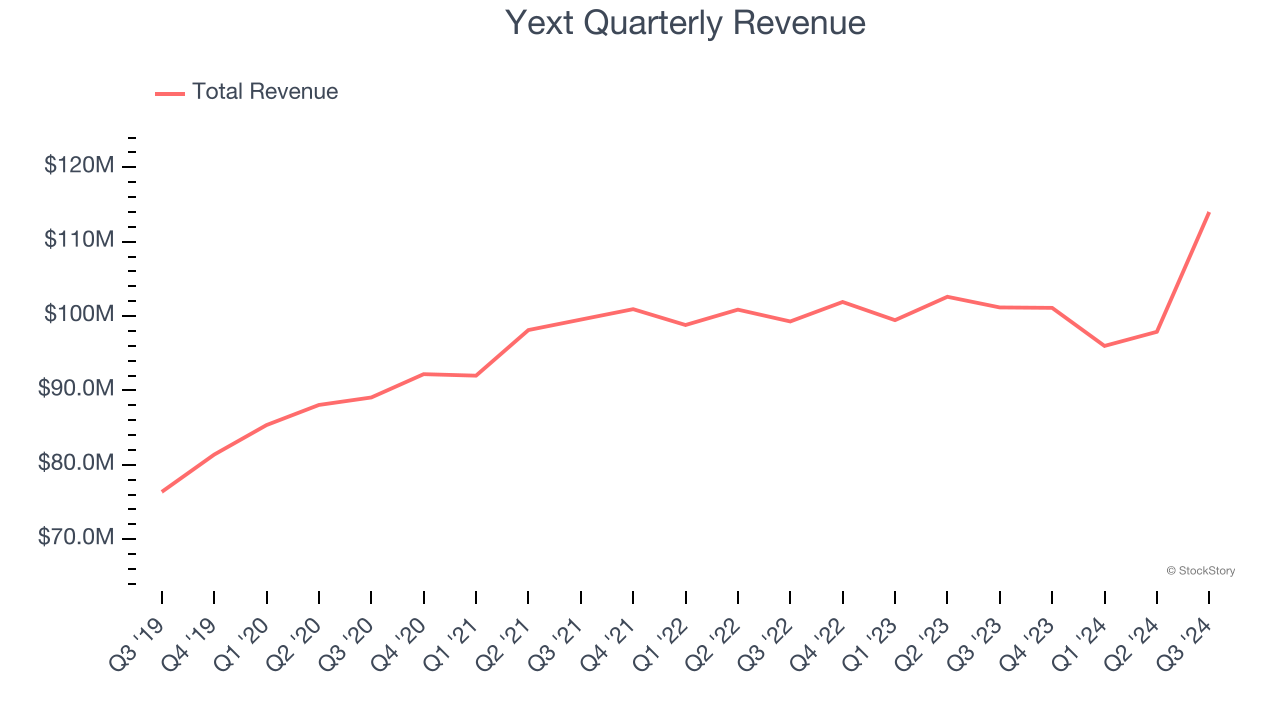

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Yext grew its sales at a weak 2.3% compounded annual growth rate. This fell short of our benchmarks.

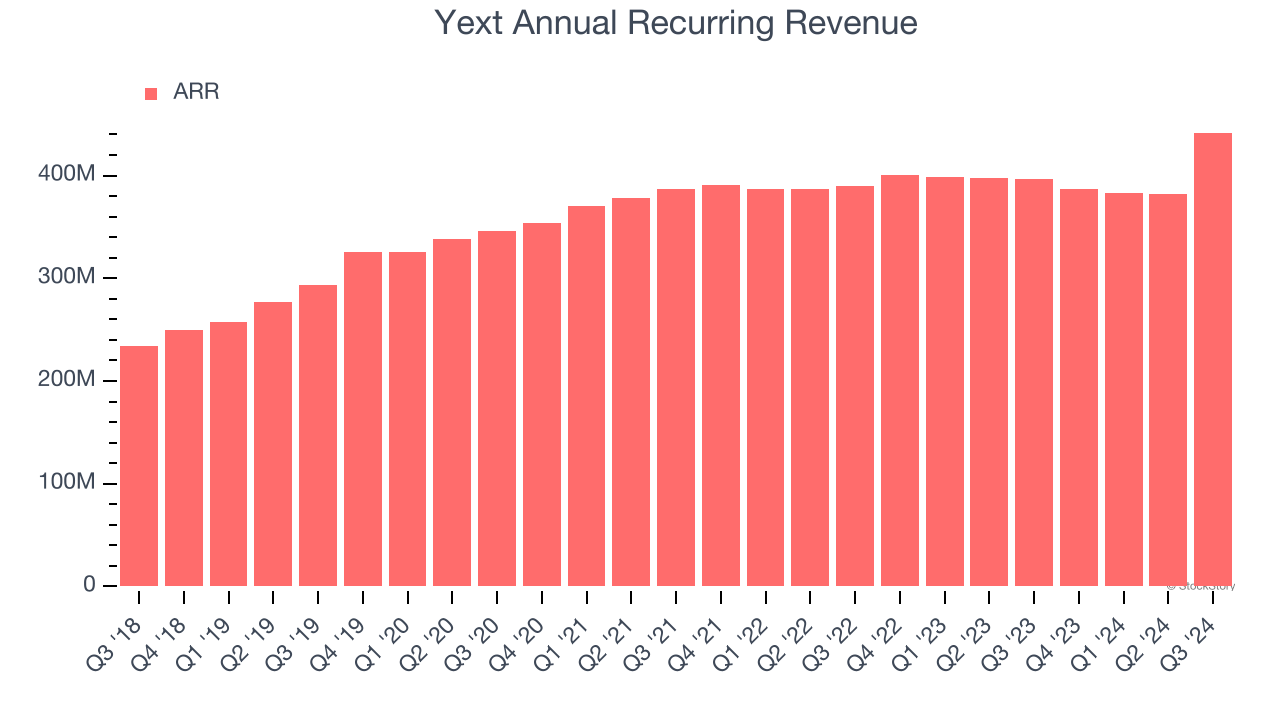

2. ARR Hits a Plateau

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Yext failed to grow its ARR, which came in at $441.8 million in the latest quarter. This performance was underwhelming, showing the company faced challenges in winning long-term deals and renewals. It also suggests there may be increasing competition or market saturation.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Yext’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Yext’s products and its peers.

Final Judgment

Yext isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.8× forward price-to-sales (or $6.31 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward our favorite picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of Yext

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.