Internet, cable TV, and phone provider Cable One (NYSE:CABO) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 6.4% year on year to $393.6 million. Its GAAP profit of $7.58 per share was 15.9% below analysts’ consensus estimates.

Is now the time to buy Cable One? Find out by accessing our full research report, it’s free.

Cable One (CABO) Q3 CY2024 Highlights:

- Revenue: $393.6 million vs analyst estimates of $391.2 million (in line)

- EPS: $7.58 vs analyst expectations of $9.01 (15.9% miss)

- EBITDA: $213.6 million vs analyst estimates of $210.6 million (1.4% beat)

- Gross Margin (GAAP): 73.4%, in line with the same quarter last year

- Operating Margin: 28%, down from 31.5% in the same quarter last year

- EBITDA Margin: 54.3%, in line with the same quarter last year

- Free Cash Flow Margin: 25.2%, similar to the same quarter last year

- Residential Data Subscribers: 959,800 at quarter end

- Market Capitalization: $2.35 billion

“As anticipated, the average revenue per unit (“ARPU”) for our residential data services stabilized during the third quarter of 2024,” said Julie Laulis, Cable One President and CEO.

Company Overview

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

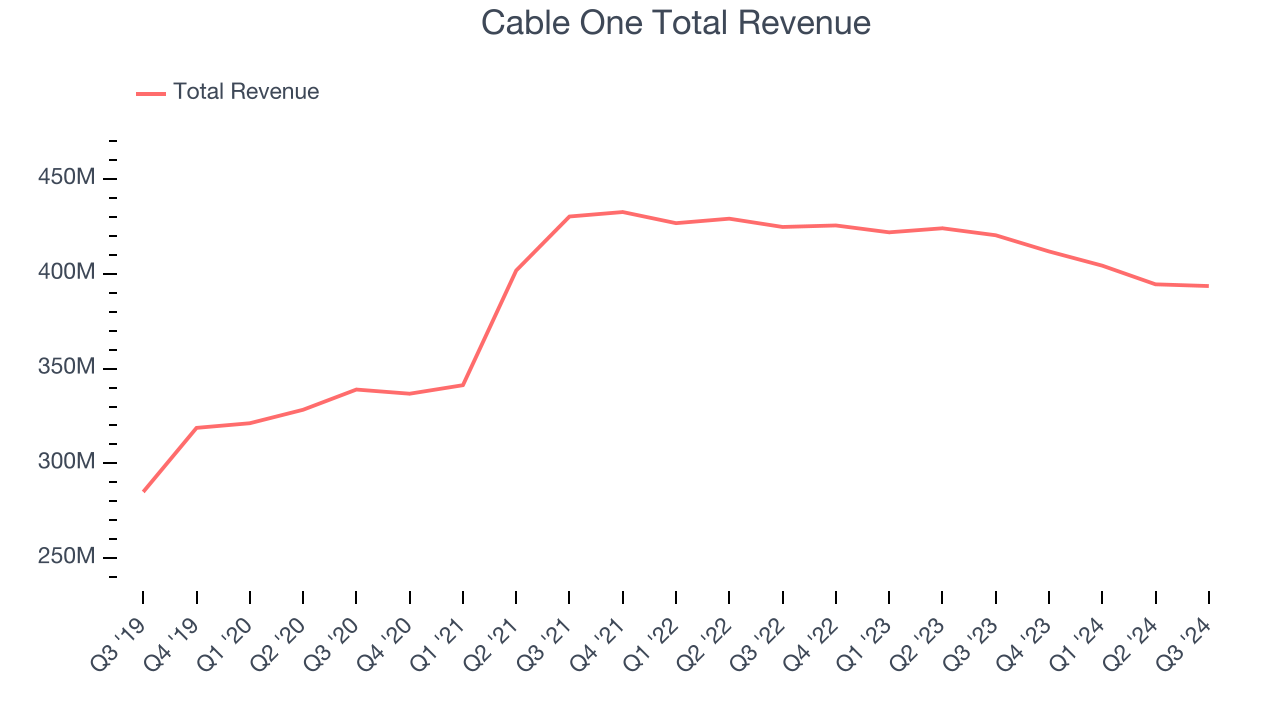

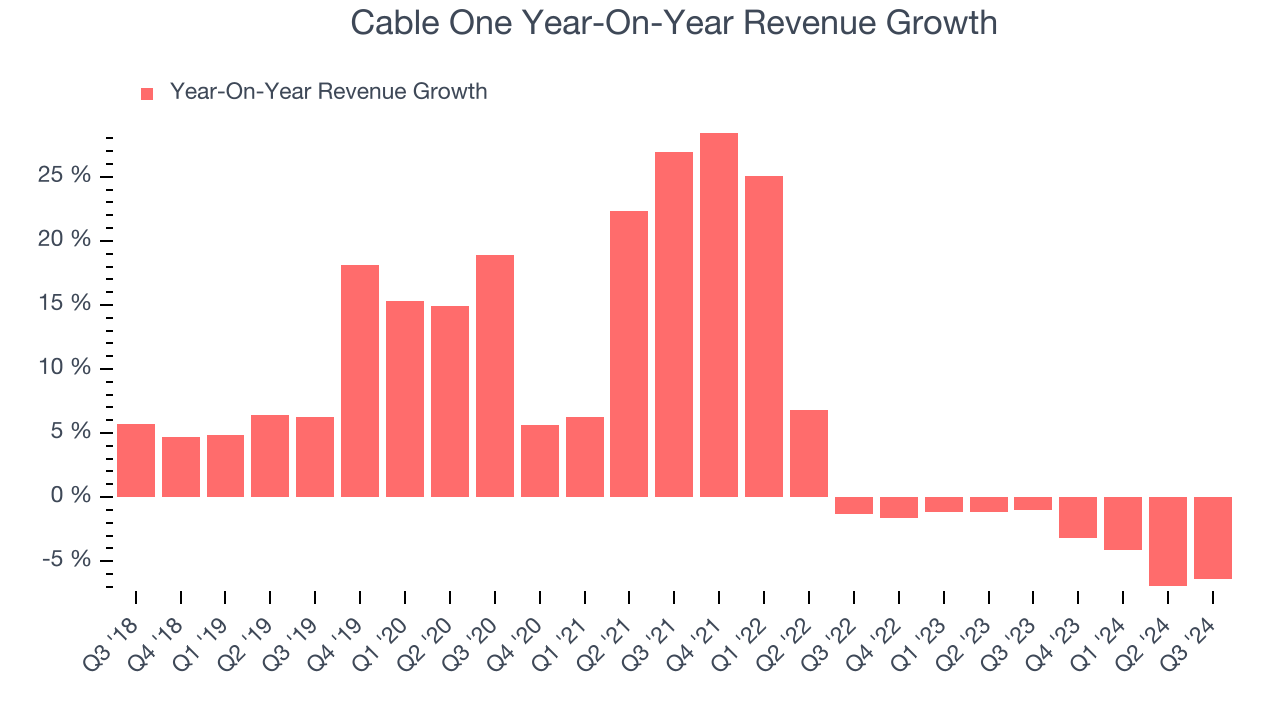

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Cable One’s sales grew at a sluggish 7.5% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Cable One’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.2% annually.

This quarter, Cable One reported a rather uninspiring 6.4% year-on-year revenue decline to $393.6 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline 2.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and illustrates the market thinks its newer products and services will not lead to better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

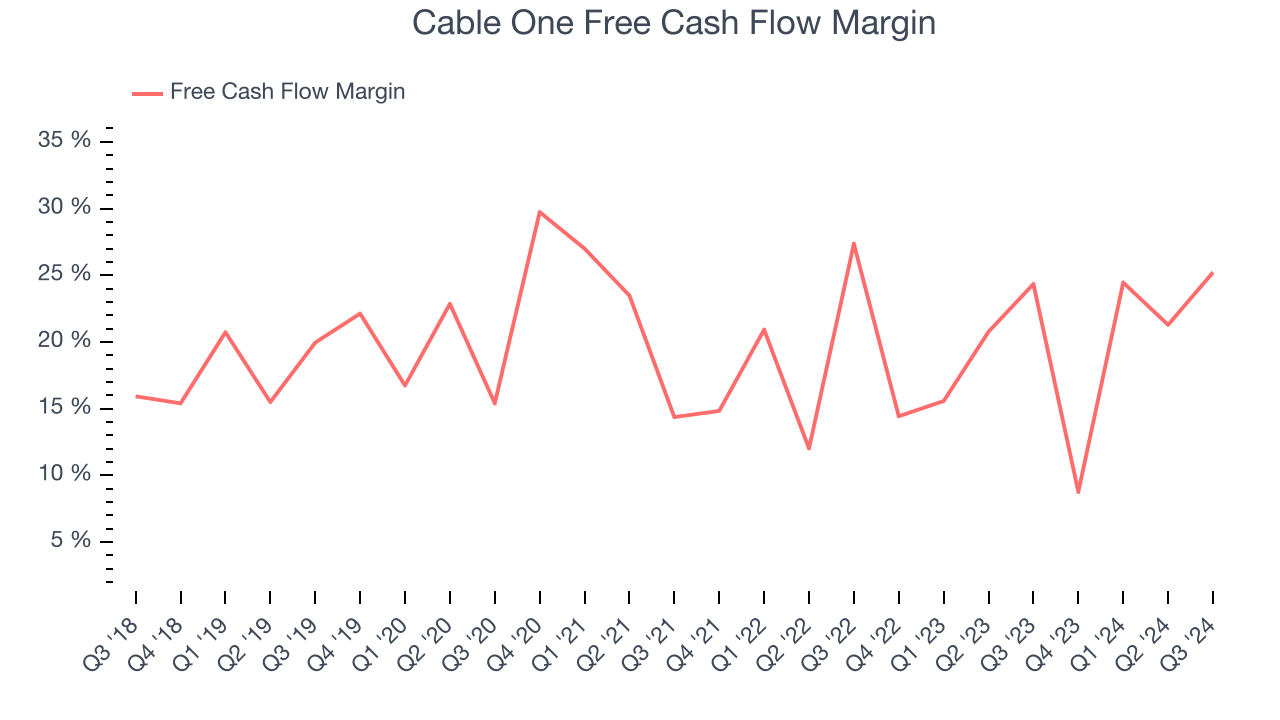

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Cable One has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 19.3% over the last two years, quite impressive for a consumer discretionary business.

Cable One’s free cash flow clocked in at $99.24 million in Q3, equivalent to a 25.2% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Over the next year, analysts predict Cable One’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 19.8% for the last 12 months will increase to 21.1%, it options for capital deployment (investments, share buybacks, etc.).

Key Takeaways from Cable One’s Q3 Results

We struggled to find many strong positives in these results. Overall, this quarter could have been better. The stock remained flat at $386.58 immediately after reporting.

The latest quarter from Cable One’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.