Vertically integrated manufacturing solutions provider Mayville Engineering Company (NYSE:MEC) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 14.4% year on year to $135.4 million. The company’s full-year revenue guidance of $585 million at the midpoint came in 7.3% below analysts’ estimates. Its non-GAAP profit of $0.21 per share was also 13.9% below analysts’ consensus estimates.

Is now the time to buy Mayville Engineering? Find out by accessing our full research report, it’s free.

Mayville Engineering (MEC) Q3 CY2024 Highlights:

- Revenue: $135.4 million vs analyst estimates of $157.6 million (14.1% miss)

- Adjusted EPS: $0.21 vs analyst expectations of $0.24 (13.9% miss)

- EBITDA: $17.06 million vs analyst estimates of $18.18 million (6.1% miss)

- The company dropped its revenue guidance for the full year to $585 million at the midpoint from $630 million, a 7.1% decrease

- EBITDA guidance for the full year is $64.5 million at the midpoint, below analyst estimates of $72.12 million

- Gross Margin (GAAP): 12.6%, in line with the same quarter last year

- Operating Margin: 4.2%, in line with the same quarter last year

- EBITDA Margin: 12.6%, in line with the same quarter last year

- Free Cash Flow Margin: 11.1%, similar to the same quarter last year

- Market Capitalization: $432 million

“During the third quarter, we took decisive action to successfully navigate a soft near-term demand environment, while continuing to deliver strong execution on our strategic priorities, as outlined within our MBX framework,” stated Jag Reddy, President and Chief Executive Officer.

Company Overview

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE:MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

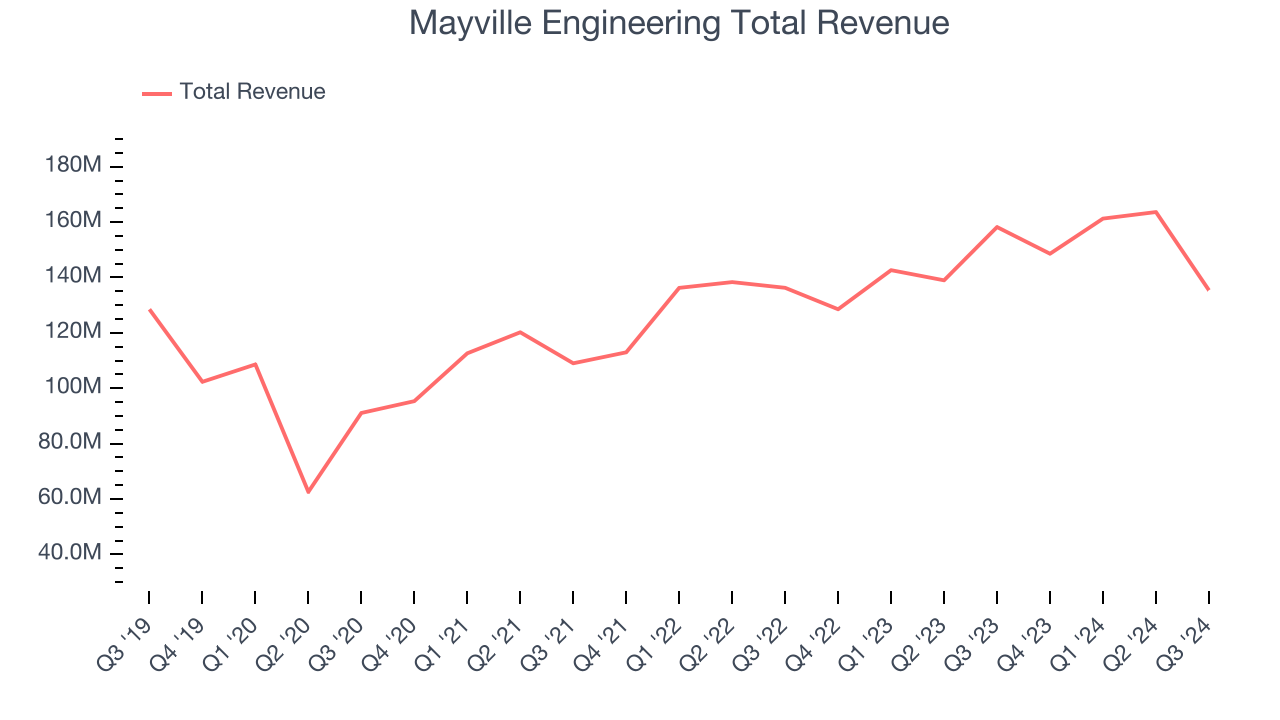

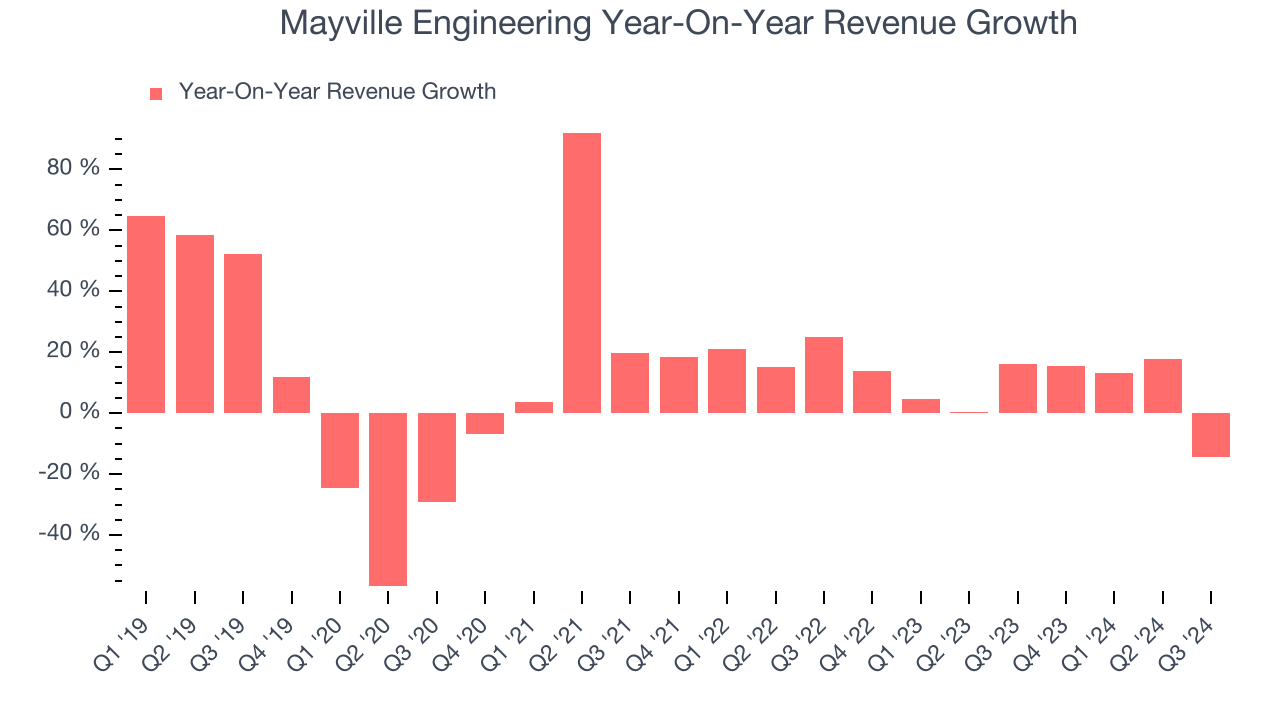

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Mayville Engineering’s 3.7% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mayville Engineering’s annualized revenue growth of 7.8% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Commercial Vehicle and Construction & Access, which are 38.1% and 14.9% of revenue. Over the last two years, Mayville Engineering’s Commercial Vehicle revenue (exhaust, engine components, fuel systems) averaged 8% year-on-year growth. On the other hand, its Construction & Access revenue (fenders, hoods, frames for heavy machinery) averaged 2.9% declines.

This quarter, Mayville Engineering missed Wall Street’s estimates and reported a rather uninspiring 14.4% year-on-year revenue decline, generating $135.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and illustrates the market believes its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

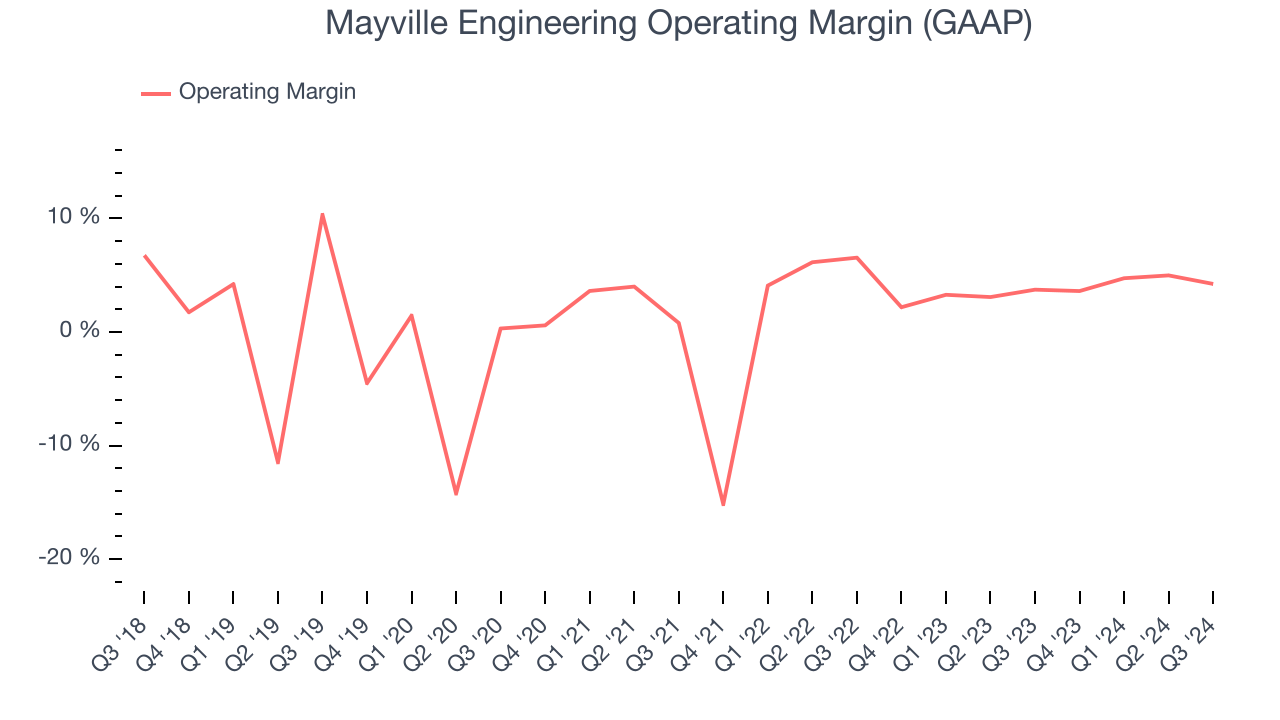

Mayville Engineering was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Mayville Engineering’s annual operating margin rose by 7.6 percentage points over the last five years.

In Q3, Mayville Engineering generated an operating profit margin of 4.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

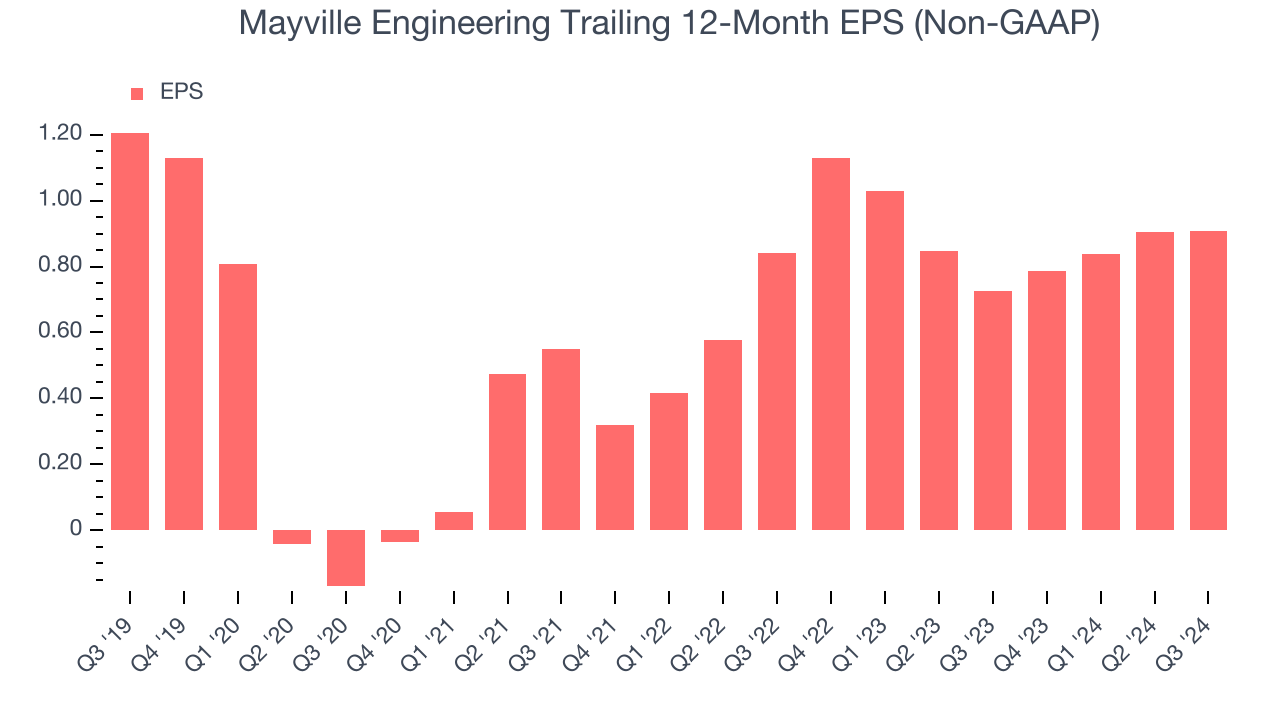

Sadly for Mayville Engineering, its EPS declined by 5.5% annually over the last five years while its revenue grew by 3.7%. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

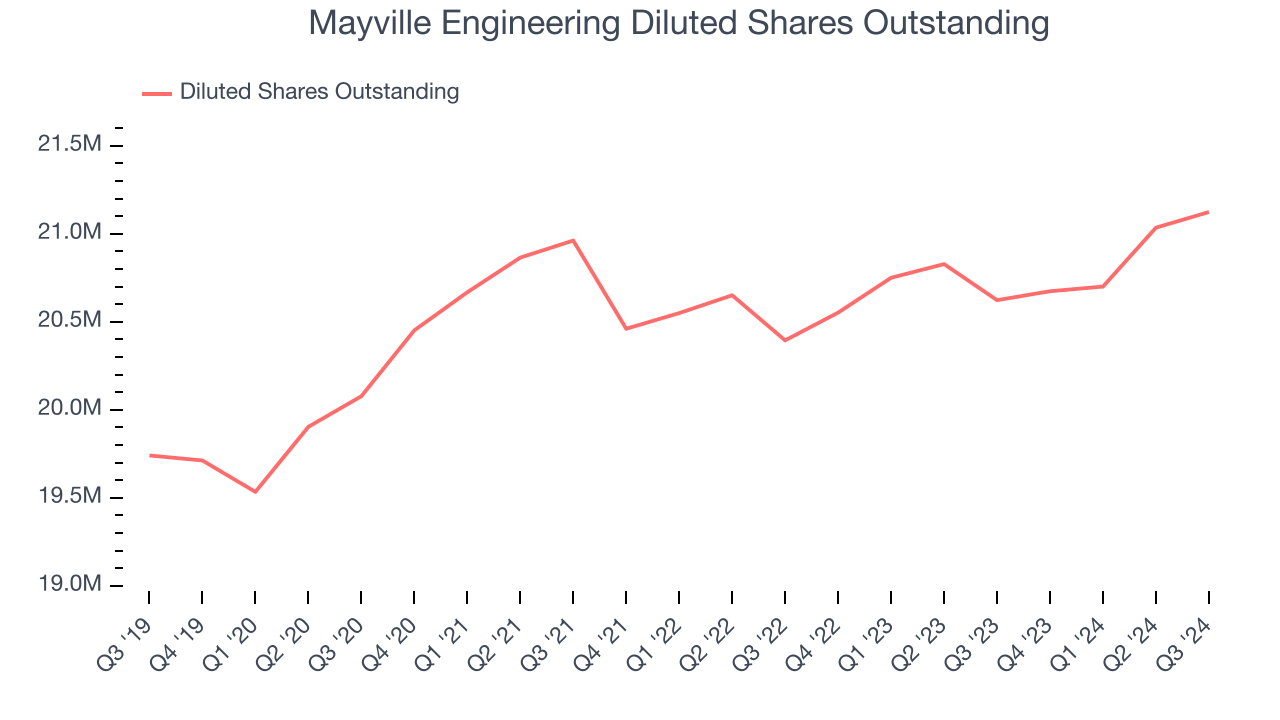

Diving into the nuances of Mayville Engineering’s earnings can give us a better understanding of its performance. A five-year view shows Mayville Engineering has diluted its shareholders, growing its share count by 7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Mayville Engineering, its two-year annual EPS growth of 3.9% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.In Q3, Mayville Engineering reported EPS at $0.21, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Mayville Engineering’s full-year EPS of $0.91 to grow by 41.5%.

Key Takeaways from Mayville Engineering’s Q3 Results

We struggled to find many strong positives in these results as its revenue and earnings missed Wall Street’s estimates. It also lowered its full-year revenue and EBITDA guidance. Overall, this was a weaker quarter. The stock remained flat at $21.81 immediately after reporting.

Is Mayville Engineering an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.