Affordable single-family home construction company LGI Homes (NASDAQ:LGIH) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 5.6% year on year to $651.9 million. Its GAAP profit of $2.95 per share was also 16.9% above analysts’ consensus estimates.

Is now the time to buy LGI Homes? Find out by accessing our full research report, it’s free.

LGI Homes (LGIH) Q3 CY2024 Highlights:

- Revenue: $651.9 million vs analyst estimates of $641.8 million (1.6% beat)

- EPS: $2.95 vs analyst estimates of $2.52 (16.9% beat)

- Gross Margin (GAAP): 25.1%, in line with the same quarter last year

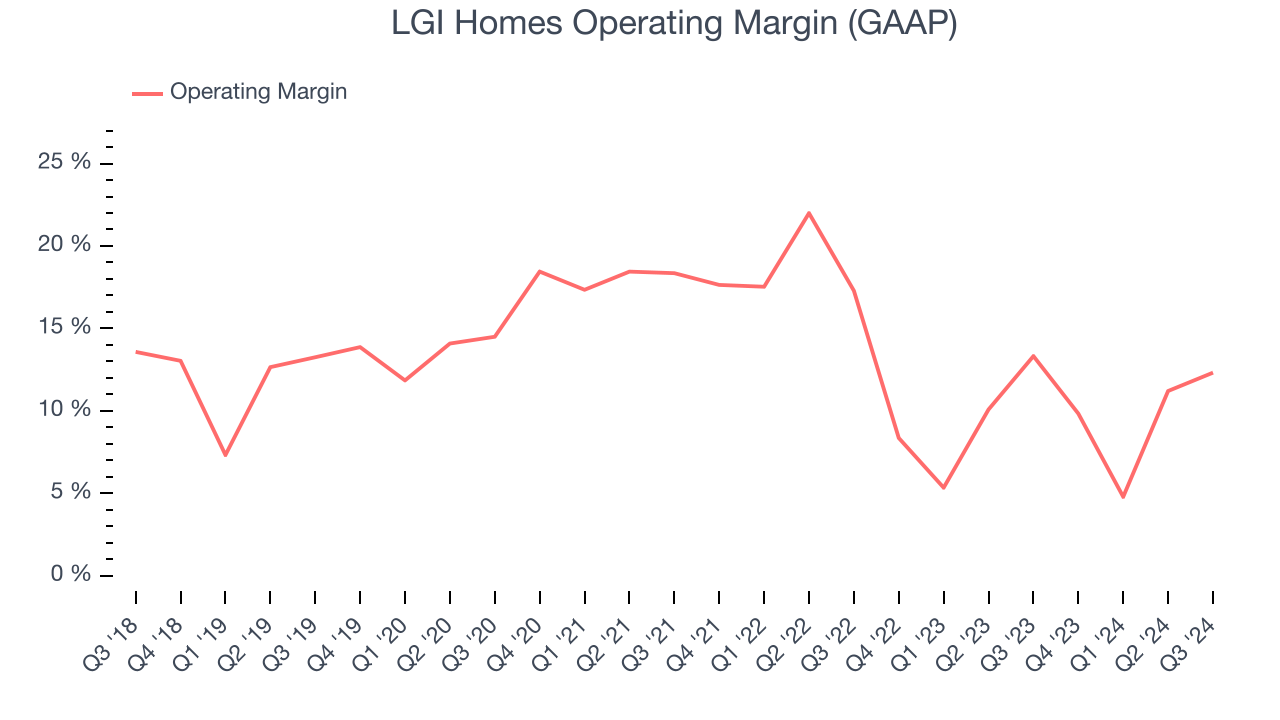

- Operating Margin: 12.3%, down from 13.3% in the same quarter last year

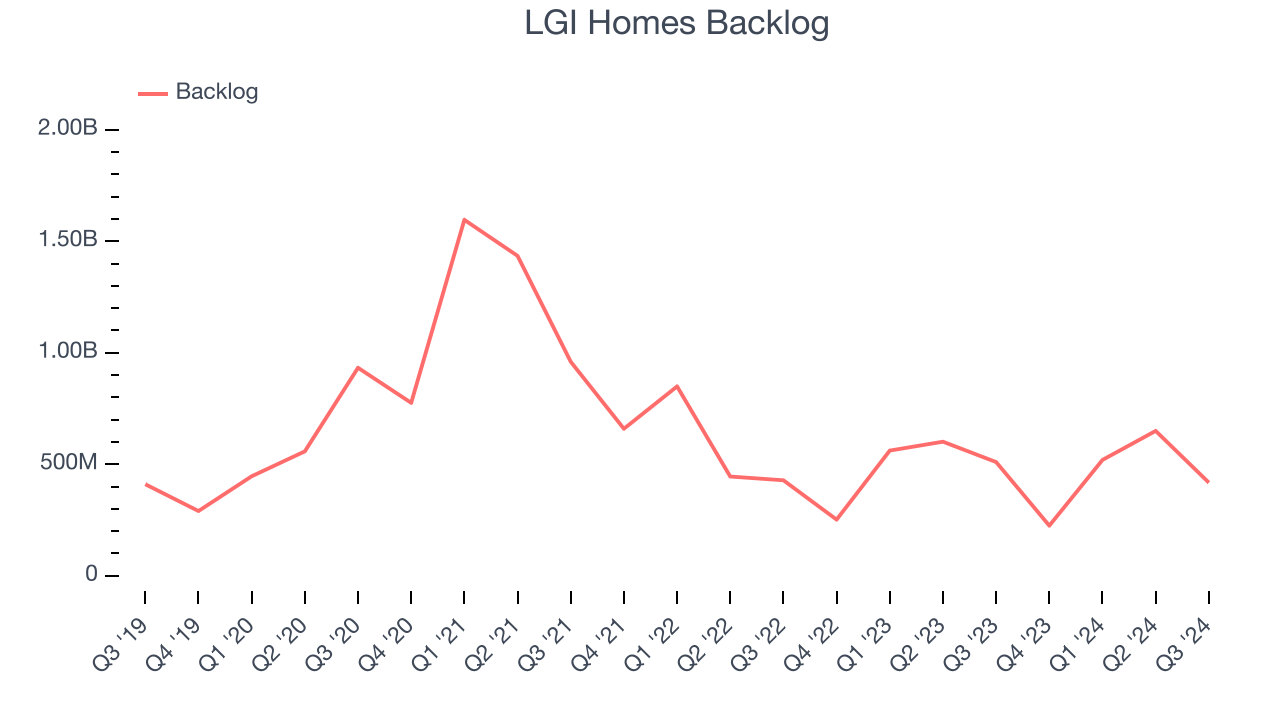

- Backlog: $417.8 million at quarter end, down 18.1% year on year

- Market Capitalization: $2.43 billion

“Our strong third quarter financial results reflect our focus on operational excellence and a commitment to maximize our profitability,” said Eric Lipar, Chairman and Chief Executive Officer of LGI Homes.

Company Overview

Based in Texas, LGI Homes (NASDAQ:LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Sales Growth

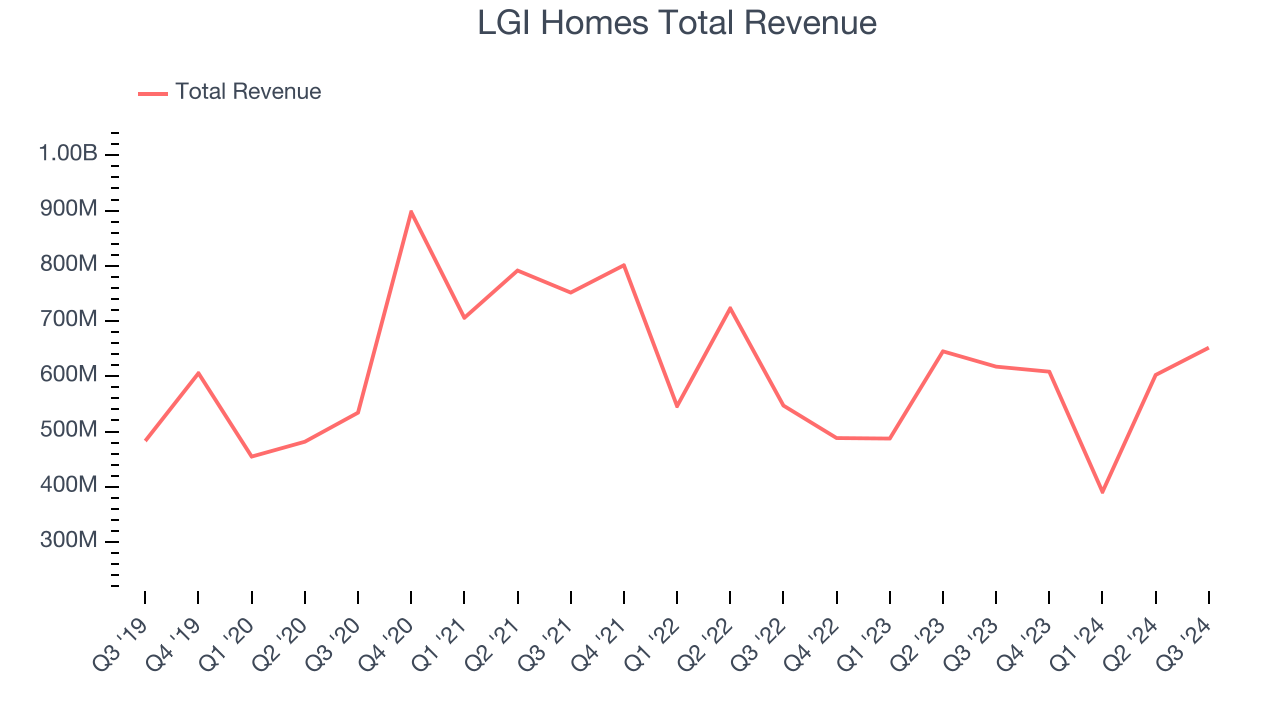

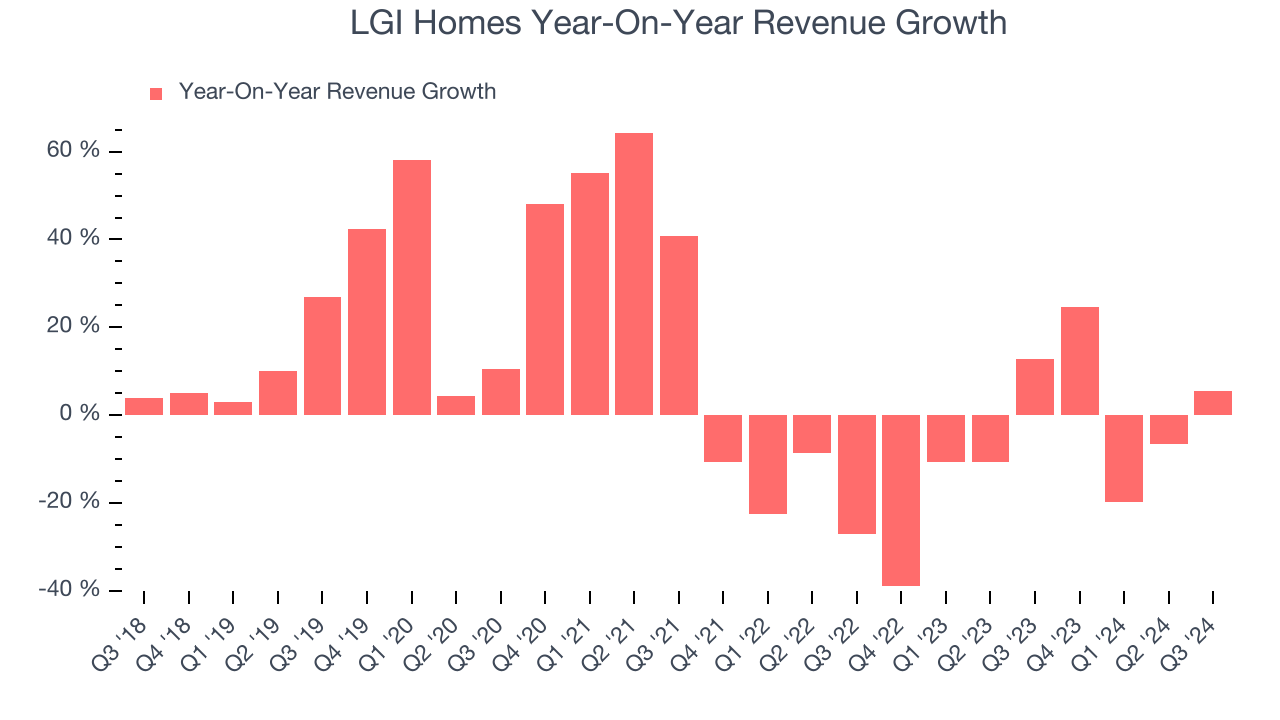

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, LGI Homes grew its sales at a mediocre 6.3% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. LGI Homes’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.2% annually.

LGI Homes also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. LGI Homes’s backlog reached $417.8 million in the latest quarter and averaged 8.7% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, LGI Homes reported year-on-year revenue growth of 5.6%, and its $651.9 million of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 36.9% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates the market believes its newer products and services will catalyze higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

LGI Homes has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, LGI Homes’s annual operating margin decreased by 3.6 percentage points over the last five years. Even though its margin is still high, shareholders will want to see LGI Homes become more profitable in the future.

In Q3, LGI Homes generated an operating profit margin of 12.3%, down 1 percentage points year on year. Since LGI Homes’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

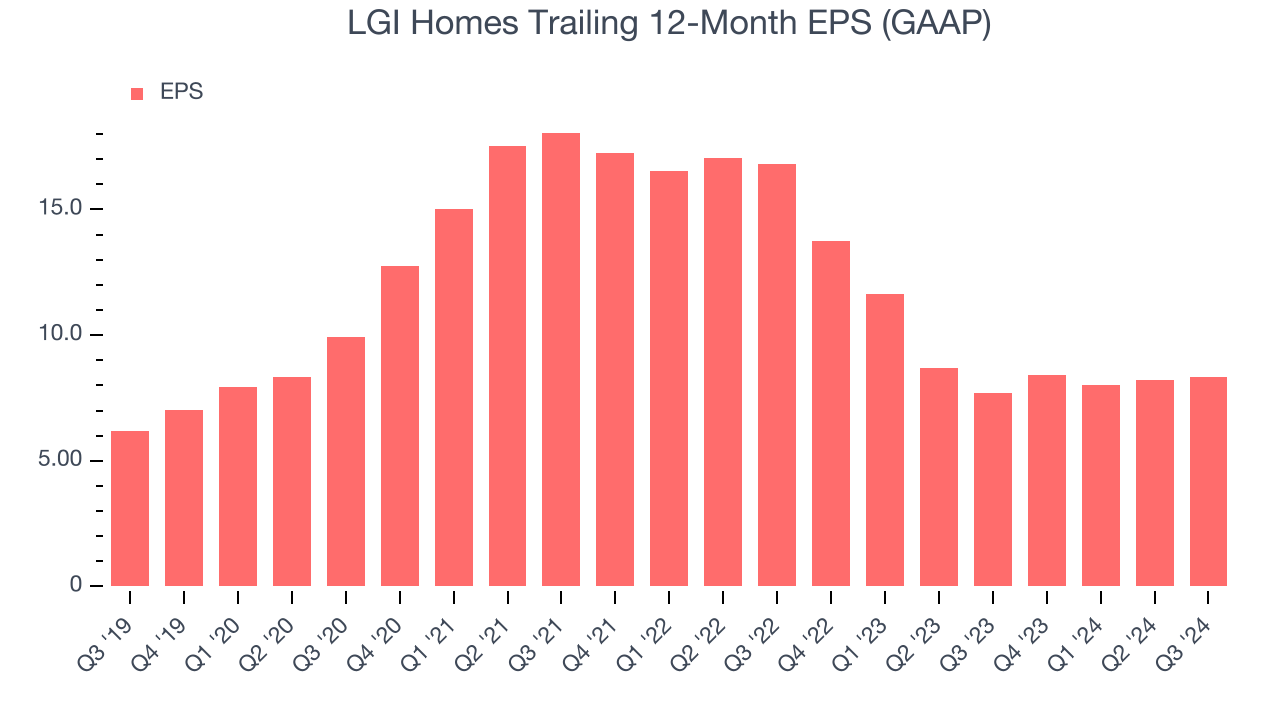

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

LGI Homes’s unimpressive 6.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

LGI Homes’s two-year annual EPS declines of 29.6% were bad and lower than its two-year revenue performance.In Q3, LGI Homes reported EPS at $2.95, up from $2.84 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects LGI Homes’s full-year EPS of $8.35 to grow by 33.4%.

Key Takeaways from LGI Homes’s Q3 Results

We enjoyed seeing LGI Homes exceed analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its backlog missed. Overall, this was a decent quarter. The stock traded up 3.5% to $106.99 immediately following the results.

So should you invest in LGI Homes right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.