Workforce housing company Target Hospitality (NASDAQ:TH) beat Wall Street’s revenue expectations in Q3 CY2024, but sales fell 34.8% year on year to $95.19 million. The company expects the full year’s revenue to be around $380 million, close to analysts’ estimates. Its GAAP profit of $0.20 per share was also 62.2% above analysts’ consensus estimates.

Is now the time to buy Target Hospitality? Find out by accessing our full research report, it’s free.

Target Hospitality (TH) Q3 CY2024 Highlights:

- Revenue: $95.19 million vs analyst estimates of $87.9 million (8.3% beat)

- EPS: $0.20 vs analyst estimates of $0.12 ($0.08 beat)

- EBITDA: $49.71 million vs analyst estimates of $41.67 million (19.3% beat)

- The company reconfirmed its revenue guidance for the full year of $380 million at the midpoint

- EBITDA guidance for the full year is $187 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 47.5%, down from 59.4% in the same quarter last year

- Operating Margin: 29.4%, down from 46.4% in the same quarter last year

- EBITDA Margin: 52.2%, down from 65.1% in the same quarter last year

- Free Cash Flow Margin: 24.9%, similar to the same quarter last year

- Utilized Beds: 13,138 at quarter end

- Market Capitalization: $925 million

"The third quarter results were supported by strong business fundamentals and our proven operational flexibility. These elements enable Target to quickly align with customer demand, while consistently achieving our financial goals," stated Brad Archer, President and Chief Executive Officer.

Company Overview

Essentially a builder of mini communities, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

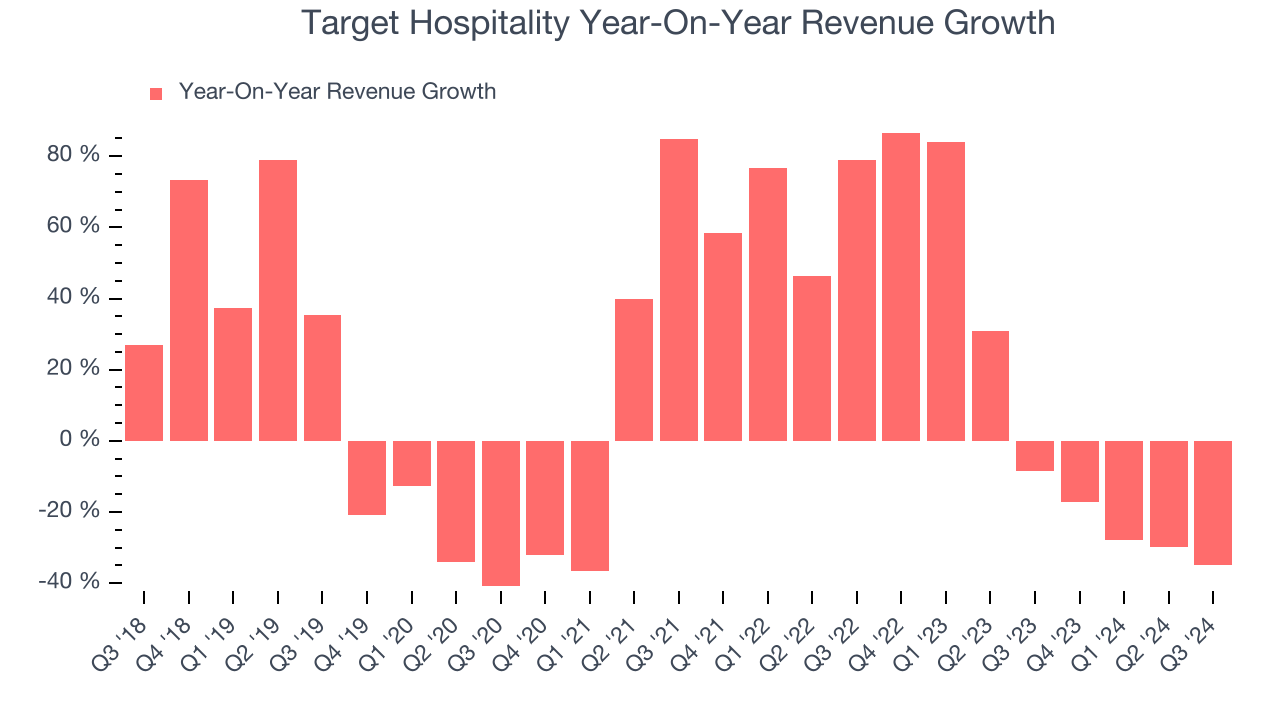

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Target Hospitality’s sales grew at a sluggish 4.7% compounded annual growth rate over the last five years. This fell short of our expectations, but there are still things to like about Target Hospitality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Target Hospitality’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Target Hospitality’s revenue fell 34.8% year on year to $95.19 million but beat Wall Street’s estimates by 8.3%.

Looking ahead, sell-side analysts expect revenue to decline 20.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

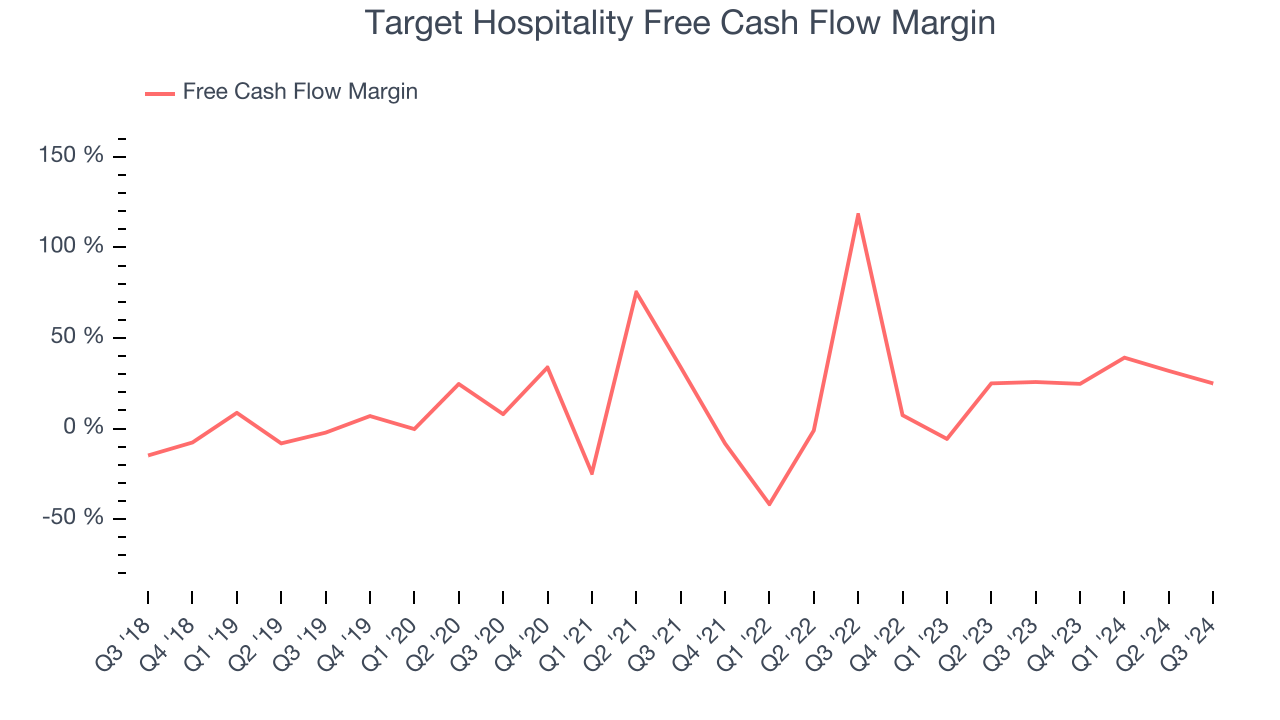

Target Hospitality has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 20.1% over the last two years, quite impressive for a consumer discretionary business.

Target Hospitality’s free cash flow clocked in at $23.71 million in Q3, equivalent to a 24.9% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from Target Hospitality’s Q3 Results

We were impressed by how significantly Target Hospitality blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 2.5% to $9.43 immediately following the results.

Sure, Target Hospitality had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.