Fresh produce company Fresh Del Monte (NYSE:FDP) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 1.6% year on year to $1.02 billion. Its non-GAAP profit of $0.77 per share was also 65.6% above analysts’ consensus estimates.

Is now the time to buy Fresh Del Monte Produce? Find out by accessing our full research report, it’s free.

Fresh Del Monte Produce (FDP) Q3 CY2024 Highlights:

- Revenue: $1.02 billion vs analyst estimates of $989.5 million (3% beat)

- Adjusted EPS: $0.77 vs analyst estimates of $0.47 (65.6% beat)

- EBITDA: $68.3 million vs analyst estimates of $55 million (24.2% beat)

- Gross Margin (GAAP): 9.3%, up from 8.3% in the same quarter last year

- Operating Margin: 5.3%, up from 3.3% in the same quarter last year

- EBITDA Margin: 6.7%, up from 5.7% in the same quarter last year

- Free Cash Flow Margin: 3%, similar to the same quarter last year

- Market Capitalization: $1.39 billion

"We are pleased to report strong performance in the third quarter. Our strategic focus on high-margin, value-added products continues to deliver positive results, demonstrating the strength of our product innovations and our commitment to driving long-term profitability and value for our shareholders,” said Fresh Del Monte Chairman and CEO Mohammad Abu-Ghazaleh.

Company Overview

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Fresh Del Monte Produce carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

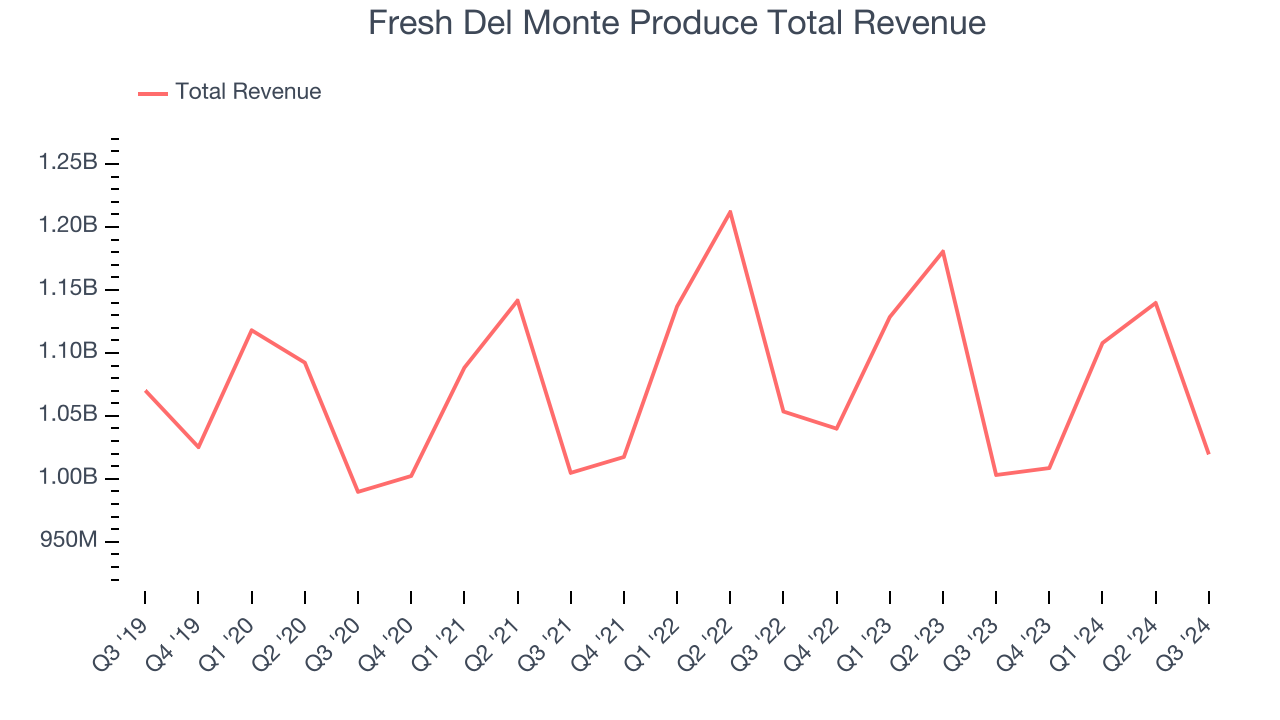

As you can see below, Fresh Del Monte Produce’s demand was weak over the last three years. Its sales were flat, showing demand was soft. This is a tough starting point for our analysis.

This quarter, Fresh Del Monte Produce reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 3%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

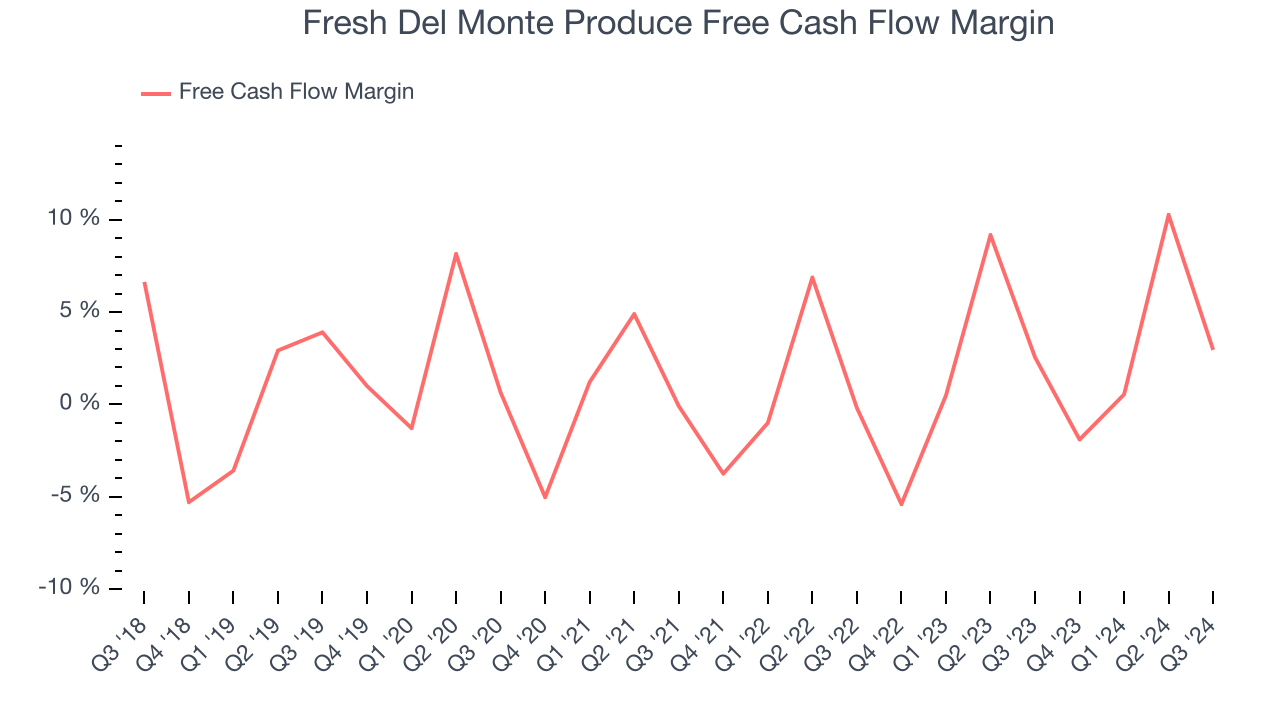

Fresh Del Monte Produce has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.5%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Fresh Del Monte Produce’s margin expanded by 1.2 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could signal it’s becoming a less capital-intensive business.

Fresh Del Monte Produce’s free cash flow clocked in at $30.1 million in Q3, equivalent to a 3% margin. This cash profitability was in line with the comparable period last year and its two-year average.

Key Takeaways from Fresh Del Monte Produce’s Q3 Results

We were impressed by how significantly Fresh Del Monte Produce blew past analysts’ EBITDA and EPS expectations this quarter. We were also excited its revenue and gross margin outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5% to $30.50 immediately after reporting.

Indeed, Fresh Del Monte Produce had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.