Online marketplace eBay (NASDAQ:EBAY) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 3% year on year to $2.58 billion. On the other hand, next quarter’s revenue guidance of $2.56 billion was less impressive, coming in 3.4% below analysts’ estimates. Its non-GAAP profit of $1.19 per share was in line with analysts’ consensus estimates.

Is now the time to buy eBay? Find out by accessing our full research report, it’s free.

eBay (EBAY) Q3 CY2024 Highlights:

- Revenue: $2.58 billion vs analyst estimates of $2.55 billion (1.2% beat)

- Adjusted EPS: $1.19 vs analyst expectations of $1.18 (in line)

- EBITDA: $687 million vs analyst estimates of $771.4 million (10.9% miss)

- Revenue Guidance for Q4 CY2024 is $2.56 billion at the midpoint, below analyst estimates of $2.65 billion

- Adjusted EPS guidance for the full year is $4.82 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 71.8%, in line with the same quarter last year

- Operating Margin: 23.1%, up from 18.2% in the same quarter last year

- EBITDA Margin: 26.7%, down from 30.2% in the same quarter last year

- Free Cash Flow Margin: 25.1%, up from 10.8% in the previous quarter

- Active Buyers: 133 million, in line with the same quarter last year

- Market Capitalization: $30.69 billion

"We achieved another quarter of positive GMV growth and delivered strong results across our key metrics," said Jamie Iannone, Chief Executive Officer at eBay.

Company Overview

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Sales Growth

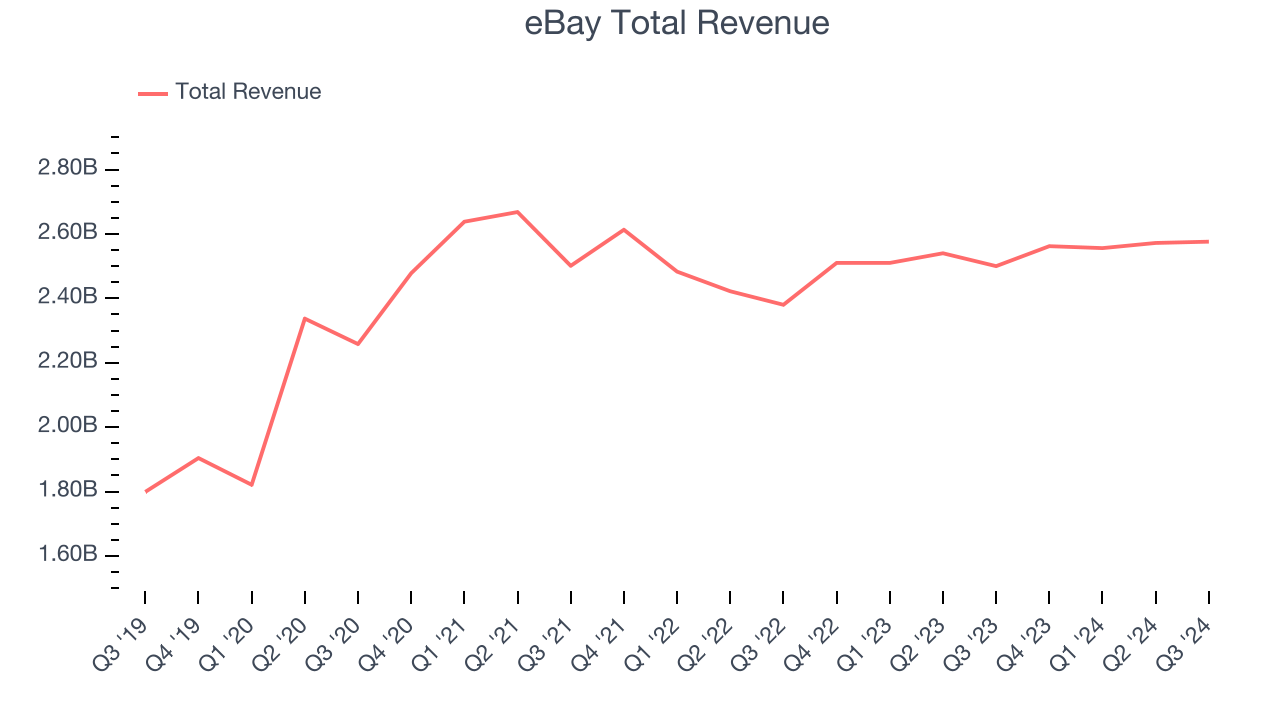

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, eBay’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

This quarter, eBay reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 1.2%. Management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, an acceleration versus the last three years. While this projection shows the market thinks its newer products and services will spur better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Active Buyers

Buyer Growth

As an online marketplace, eBay generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

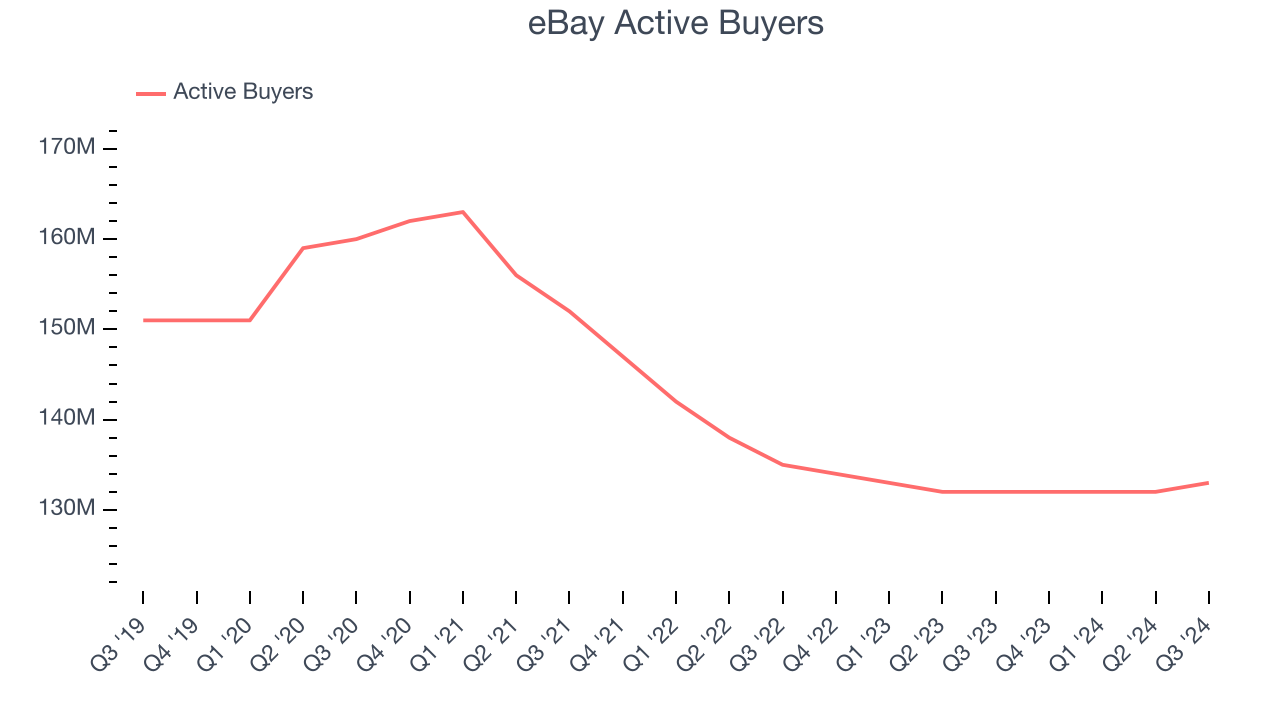

eBay struggled to engage its active buyers over the last two years as they have declined by 2.9% annually to 133 million in the latest quarter. This performance isn't ideal because internet usage is secular. If eBay wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

eBay’s active buyers were flat year on year in Q3. On the bright side, the quarterly print was higher than its two-year result and suggests its new initiatives are accelerating buyer growth.

Revenue Per Buyer

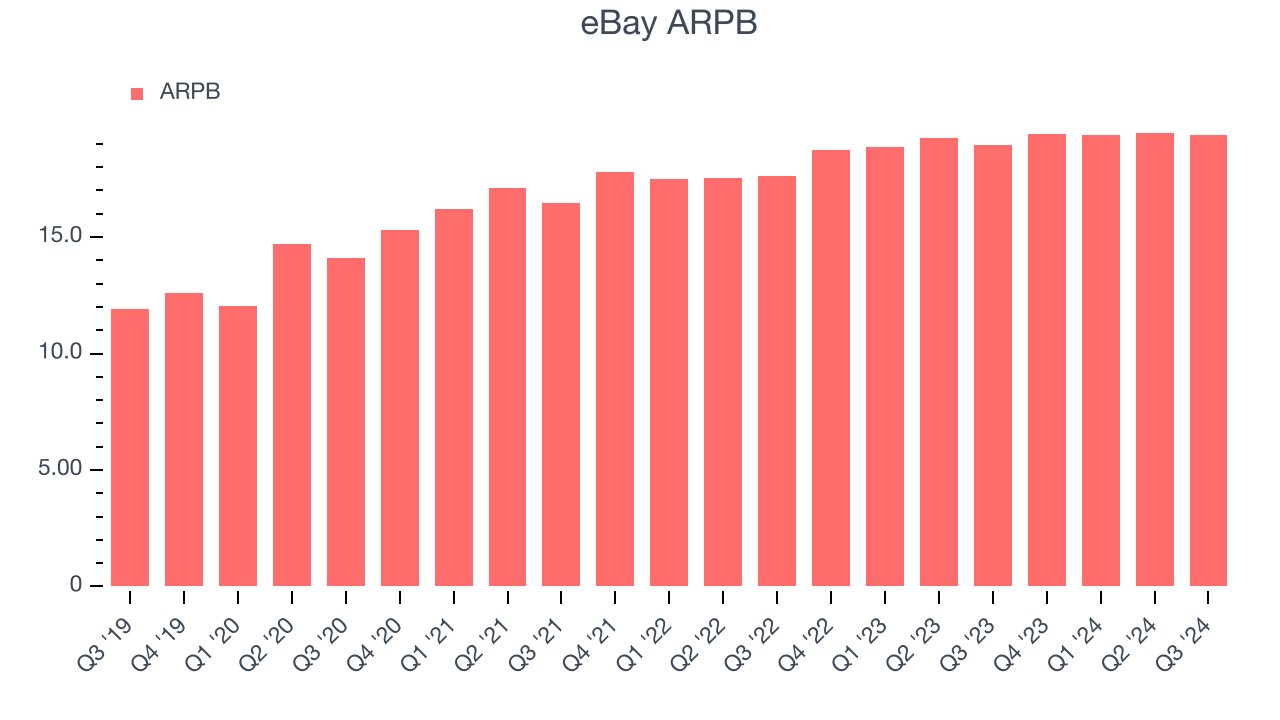

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like eBay because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and eBay’s take rate, or "cut", on each order.

eBay’s ARPB growth has been decent over the last two years, averaging 5%. Although its active buyers shrank during this time, the company’s ability to increase monetization demonstrates its platform’s value for existing buyers.

This quarter, eBay’s ARPB clocked in at $19.37. It grew 2.3% year on year, faster than its active buyers.

Key Takeaways from eBay’s Q3 Results

It was good to see eBay narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 8.4% to $57.38 immediately after reporting.

eBay didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.