Enterprise workflow software provider Pegasystems (NASDAQ:PEGA) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 2.9% year on year to $325.1 million. Its non-GAAP profit of $0.39 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Pegasystems? Find out by accessing our full research report, it’s free.

Pegasystems (PEGA) Q3 CY2024 Highlights:

- Revenue: $325.1 million vs analyst estimates of $327.7 million (slight miss)

- ACV (annual contract value): $1,332 million vs analyst estimates of $1,305 million (2.1% beat)

- RPO (remaining performance obligations): $1,475 million vs analyst estimates of $1,388 million (6.3% beat)

- Adjusted EPS: $0.39 vs analyst estimates of $0.34 (16.2% beat)

- Gross Margin (GAAP): 70.2%, down from 72% in the same quarter last year

- Operating Margin: -3.6%, in line with the same quarter last year

- Market Capitalization: $6.02 billion

“Pega GenAI Blueprint is creating enormous excitement and fundamentally changing how we engage with our clients,” said Alan Trefler, founder and CEO.

Company Overview

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

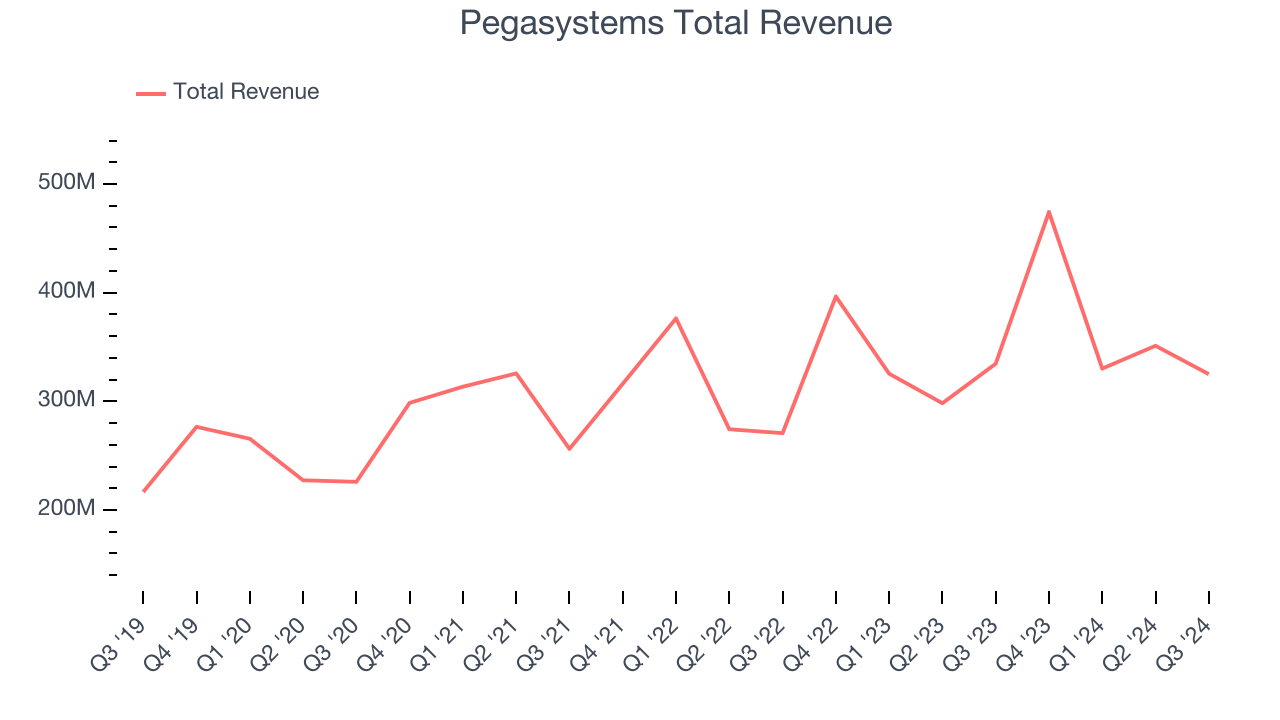

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Pegasystems grew its sales at a weak 7.4% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

This quarter, Pegasystems reported a rather uninspiring 2.9% year-on-year revenue decline to $325.1 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and shows the market believes its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

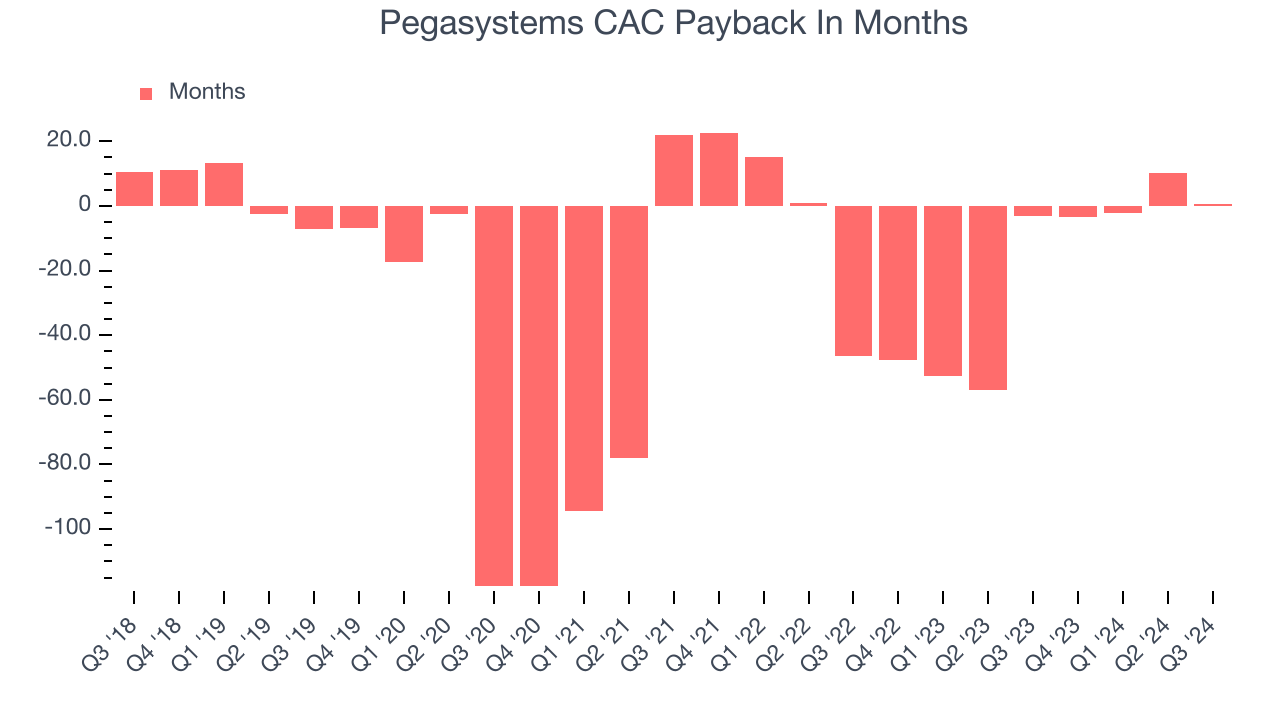

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly the business can break even on its sales and marketing investments.

Pegasystems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 0.5 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Pegasystems’s Q3 Results

While revenue missed slightly, both ACV and RPO were both ahead. These tend to get more attention than reported revenue given the nuances in Pegasystems contracts and how it sells its software. Adjusted EPS also beat. This was a mixed quarter with some key KPIs coming in ahead of expectations. The stock traded up 6.1% to $74 immediately after reporting.

So should you invest in Pegasystems right now?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.