No one told Impinj, Inc. (NASDAQ: PI) that 2022 is a down year for technology stocks.

Shares of the emerging digital tech innovator are up more than 30% so far — and by its own standards, that’s a relatively ‘weak’ performance. Over the last three calendar years, Imping has surged 78%, 62% and 112%.

Meanwhile, a witch's brew of macro headwinds and disappointing Q3 earnings reports has mega cap tech companies reeling. Alphabet, Amazon and Microsoft have each experienced spooky October drops and are down 30% or more year-to-date.

While the big names grab the headlines, Impinj continues to quietly go about its business of connecting everyday items to the digital world. Its technology is a game changer across many industries and yet it continues to fly under the radar. That may soon change.

What Does Impinj Do?

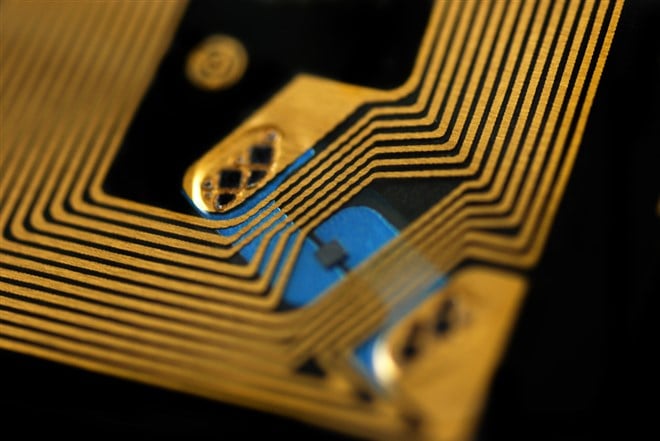

Impinj is the bridge between the physical and digital worlds. It makes radio frequency identification chips, or RFID chips, that get placed on billions of consumer products and industrial items. This allows for real-time wireless communication between ‘things’ and online systems.

The ‘Internet-of-Things’ (IoT) technology has widespread applications and offers tremendous value to customers. Businesses like clothing, sneaker, and auto parts retailers can instantly analyze and optimize inventory levels. Logistics companies can better track shipments. Slap RFID tags on suitcases and airports will (hopefully) lose less of our luggage.

It can also be used as an authentication tool to identify counterfeit goods in the supply chain. Loss prevention and self-checkout are additional applications.

Sound like niche technology with limited revenue potential? Nope. Blue-chip customers include Walmart, Target, Nike, Levi’s, McDonald’s and several others.

Impinj’s cloud-based Radio Identification (‘RAIN’) platform connects more than 60 billion items. It provides timely, accurate data that gives businesses a competitive edge. The company participates in a unique but powerful part of an IoT market that is in the early stages of an explosive growth trajectory.

Like many other semiconductor-dependent markets, the global chip shortage has slowed IoT’s pandemic recovery. As supply chain pressures ease, however, IOT Analytics projects that the number of connected IoT devices will roughly double from 2022 to 2025.

Does Impinj Have Good Fundamentals?

From 2015 to 2021, Impinj grew its sales at 16% annual rate — and that includes the inevitable Covid downturn in 2020. Even with the current macro headwinds, year-to-date sales growth has doubled to 32%.

Last week it turned in another impressive quarterly performance. Both core offerings — endpoints and readers — posted record revenue. Total revenue jumped 51% year-over-year and the bottom line swung from a $0.04 per share loss to adjusted EPS of $0.34.

Through the first nine months of the year, Impinj earnings have increased nearly sevenfold compared to 2021. So needless to say, the growth metrics are phenomenal.

Another mark of strong fundamentals is improving profitability. In sharp contrast to escalating expenses at Meta Platforms and other tech giants, Impinj’s margins are expanding. In Q3, the gross margin swelled to 54.8% from 50.9% in the prior year period.

Better yet, the company ended the period with a record order backlog. Co-founder and CEO Chris Diorio said he expects “demand to remain strong well into 2023.” Rising demand combined with improving product availability sounds like the making of another stellar year.

The balance sheet is in good shape as well. As of September 30th, Impinj had approximately $182 million in cash and $280 million in long-term debt. With none of the long-term debt coming due within the next 12 months, liquidity ratios are healthy — which should enable the pursuit of growth projects.

Is There More Upside to Impinj Stock?

After rebounding 8% in 2021, the IoT market is expected to grow 18% this year. As chip constraints improve and the buildout of 5G and other wireless networks ramp, this growth is projected to accelerate. This means demand for Impinj products and services should only gain momentum. The company estimates that less than 0.3% of the world’s connectable items are connected, including consumables and other everyday objects.

Only a half dozen sell-side research firms actively cover Impinj, although more are likely to follow. Even after an 11x return off the March 2020 low, the group remains unanimously bullish. In the wake of the Q3 release, all reiterated their buy ratings and there were price target hikes aplenty.

With that said, the stock has already run up towards the high end of the Street’s price target range of $120, so the near-term upside appears limited. On the other hand, analysts have been playing catch-up with this name all along — so further target increases wouldn’t be surprising.

If Impinj can power through an environment of supply chain disruption and cautious tech spending, imagine what it can do when economic conditions normalize. Don’t let the stock chart fool you. This IoT pioneer is only getting started.