Funds to Help Prevent or Remediate Property Title Issues

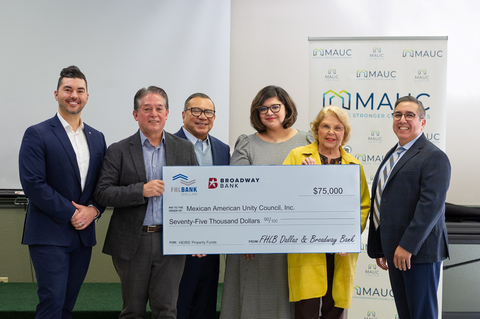

The Federal Home Loan Bank of Dallas (FHLB Dallas) awarded $75,000 in Heirs’ Property Program grants to the Mexican American Unity Council (MAUC) through its member Broadway Bank. The grant was celebrated with a ceremonial check presentation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240222651286/en/

Left to right: Jacob Cavazos, Broadway Bank, Fernando Godinez, Louie Escareno, Crystal Requejo and Adela Gonzalez of the Mexican American Unity Council and Mark Loya, FHLB Dallas. (Photo: Business Wire)

“These funds are a much-needed resource for our Latino homeowners to ensure their family inherits the wealth they have worked so hard to build,” said Fernando Godinez, president and CEO of MAUC.

The MAUC Homestead Preservation Center will utilize the funds to assist homeowners who want to maintain ownership of their homes. By providing resources that help homeowners clear title to their homes, lower their property taxes and navigate the challenges of these forces, the center helps to ensure that long-time residents can continue to thrive in their neighborhoods.

The funds are part of $905,200 in Heirs’ Property Program grants that FHLB Dallas awarded through members in 2023. The grants assisted 21 organizations with preventing or remediating heirs’ property issues. In Texas, $515,200 was awarded to 12 organizations.

Heirs’ property refers to property inherited without a will or legal documentation of ownership. As property is passed down, each successive generation generally results in more heirs being added to the inheritance. The absence of a deed or will can make it more complicated to obtain a clear title to land or homes as time passes. The inability to provide clear title can make it very difficult for families to transfer, or obtain loans on, the impacted property.

“Clearing a clouded real estate title can be a time-consuming and costly process,” said Jacob P. Cavazos, senior vice president and community reinvestment manager at Broadway Bank. “These funds are a great asset to help educate homeowners and help them resolve property issues.”

In its inaugural 2023 funding round from FHLB Dallas, organizations could receive up to $75,000. Awardees included affordable housing associations, community development groups, legal aid organizations and a university.

“Property issues disproportionately affect minority communities and low-income populations. These funds can help families break the cycle of generational poverty and improve their financial position,” said Greg Hettrick, senior vice president and director of Community Investment at FHLB Dallas.

For more information about the Heirs’ Property Program, visit fhlb.com/heirs.

About Broadway Bank

Headquartered in San Antonio, Broadway Bank is one of the largest privately owned banks in Texas, with more than $5 billion in assets and $3 billion in wealth management assets. It is privately-owned and offers a full range of financial services, including personal, business, commercial, wealth management and private banking. Broadway Bank operates financial centers in San Antonio, Austin, Dallas-Fort Worth and Houston regions. Visit Broadway Bank for more information.

About the Federal Home Loan Bank of Dallas

The Federal Home Loan Bank of Dallas is one of 11 district banks in the FHLBank System created by Congress in 1932. FHLB Dallas, with total assets of $147.6 billion as of September 30, 2023, is a member-owned cooperative that supports housing and community development by providing competitively priced loans and other credit products to approximately 800 members and associated institutions in Arkansas, Louisiana, Mississippi, New Mexico and Texas. For more information, visit our website at fhlb.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240222651286/en/

Contacts

Corporate Communications

Federal Home Loan Bank of Dallas

fhlb.com, (214) 441-8445