Amica Ranks Highest in Service Satisfaction, American Family Ranks Highest in Shopping Satisfaction

Historic rate increases in the property and casualty (P&C) insurance industry have pushed a record-high1 volume of shoppers into the marketplace to seek new quotes and switch carriers. According to the J.D. Power 2023 U.S. Insurance Digital Experience Study,SM released today, insurers have been doing a good job addressing those shoppers’ needs via the digital channel. When it comes to servicing existing customers on digital, however, overall satisfaction declines this year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230523005084/en/

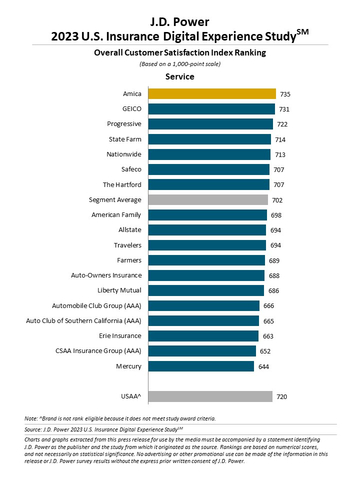

J.D. Power 2023 U.S. Insurance Digital Experience Study (Graphic: Business Wire)

“The industry is seeing historical levels of customer churn right now, which puts a spotlight on the critical role insurer digital channels play in not just attracting new customers, but also onboarding them, and in retaining existing customers,” said Stephen Crewdson, senior director, insurance business intelligence at J.D. Power. “When it comes to shopping, insurers are starting to get the formula right, but they are still lagging far behind the best-in-class offerings in other industries like banking and airlines when it comes to servicing existing customers. That needs to become a focal point if insurers really want to build lifetime customer value.”

The U.S. Insurance Digital Experience Study evaluates the digital consumer experiences of both P&C insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities. It examines the functional aspects of desktop, mobile web and mobile apps based on four factors: ease of navigation; speed; visual appeal; and information/content. The study was conducted in collaboration with Corporate Insight, the leading provider of competitive intelligence and user experience research to the financial services and healthcare industries.

“The last thing most insurance customers want to do is have to call their carrier for help with basic account servicing questions and actions,” said Michael Ellison, president of Corporate Insight. “Increasingly, the usability and accessibility of a carrier’s digital solutions plays a big role in both attracting new customers and retaining existing ones.”

Following are key findings of the 2023 study:

- Improvements in shopping experience, but still long way to go on digital: Overall customer satisfaction with the P&C insurer digital shopping experience is just 521 (on a 1,000-point scale), up 22 points from a year ago. Relative to customer satisfaction scores with digital shopping tools in other industries, such as banking and airlines, the insurance industry still has a long way to go.

- Digital service satisfaction declines: Overall customer satisfaction with the digital service experience is 702, which is down 3 points from 2022. Customers’ inability to find the information they need is the biggest single drag on service experience satisfaction. Satisfaction scores are lowest (698) when customers cannot find information on an insurer’s website or app and end up having to call the insurer, which happens 42% of the time.

- Wide variation in app performance: In account servicing, the study finds significant gaps in mobile app performance. The average satisfaction score among the top-performing 25% of customers using a mobile app is 872—substantially higher than any other channel. However, satisfaction among the bottom 25% of customers using a mobile app declines 305 points to 567.

- Traditional carriers edge out InsurTechs on digital service and shopping: Overall customer satisfaction with digital account servicing and shopping is slightly higher among traditional insurers when compared to digital native InsurTech brands. While InsurTechs outperform on the research policy information metric, traditional carriers are performing as well or better on all other key factors. Traditional insurers perform particularly well on ability to make digital payments, ability to locate contact information and ability to make profile updates.

Study Rankings

Amica ranks highest in the service segment with a score of 735. GEICO (731) ranks second and Progressive (722) ranks third.

American Family ranks highest in the shopping segment with a score of 549. Farmers (547) ranks second and Automobile Club Group (AAA) (543) ranks third.

The 2023 U.S. Insurance Digital Experience Study is based on 11,146 evaluations and was fielded in January-March 2023.

For more information about the U.S. Insurance Digital Experience Study, visit https://www.jdpower.com/business/insurance/us-insurance-digital-experience-study.

See the online press release at http://www.jdpower.com/pr-id/2023047.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About Corporate Insight

Corporate Insight (CI) delivers competitive intelligence, user experience research and consulting services to the nation’s leading financial and health institutions. As the recognized industry leader in customer experience research since 1992, CI has been the trusted partner to corporations seeking to improve their digital capabilities and user experience. Their best-in-class research platform and unique approach of analyzing the actual customer experience helps corporations advance their competitive position in the marketplace. To learn more, visit http://www.corporateinsight.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

________________

1 J.D. Power Quarterly Shopping LIST Report https://discover.jdpa.com/hubfs/Files/Industry%20Campaigns/Insurance/2022USINSLISTQ4Report1242023.pdf

View source version on businesswire.com: https://www.businesswire.com/news/home/20230523005084/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com