Amica Mutual and The Hartford Rank Highest in a Tie in Property Claims Satisfaction

A crippling combination of near-record high catastrophic losses, massive supply chain disruptions and ongoing workforce challenges conspired to make the past year an incredibly tough one for property and casualty (P&C) insurers. According to the J.D. Power 2022 U.S. Property Claims Satisfaction Study,SM released today, slower cycle times and growing pains associated with transitioning to digital servicing channels caused overall satisfaction scores to decline to a five-year low.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220228005211/en/

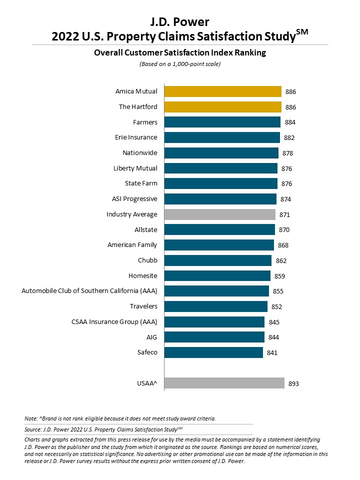

J.D. Power 2022 U.S. Property Claims Satisfaction Study (Graphic: Business Wire)

“Insurers really struggled last year, partly due to circumstances beyond their control,” said Mark Garrett, director, insurance intelligence at J.D. Power. “Longer cycle times, material shortages and personnel availability put added pressure on insurers to keep customers informed and expectations managed. Digital tools were a pivotal part of the process as customers increasingly turned to digital channels by submitting photos to assist in the estimation process and were far more willing to use the tools for status updates. Unfortunately, these digital tools are not always meeting expectations, resulting in support staff needing to get involved. That disconnect creates a major drag on customer satisfaction.”

Following are some key findings of the 2022 study:

- Overall satisfaction declines industry-wide: Overall customer satisfaction with homeowner insurance property claims falls to a five-year low of 871 (on a 1,000-point scale) as nearly every insurer’s scores were dragged down by slower cycle times, more complicated claims processes and communications challenges. On average, it took 17.8 days for claimants to have their repairs completed this year, up 2.9 days from a year ago.

- Digital claims show huge promise, but most claimants not fully using available tools: This year marks the first time a digital channel—email—overtook phone calls to and from the insurer as the most frequently used communication method. Furthermore, mobile apps had the largest increase in usage—+19 percentage points—from a year ago. However, despite these large increases, only 11% of customers fully utilize digital channels for all major steps of the claim process: digital FNOL (first notice of loss) plus digital estimation (submitting photos used for the estimate) and mobile apps or web channels for status updates. Those customers who used digital tools throughout the claim process saw their repairs get started nine days sooner, and overall satisfaction scores among such customers is 33 points higher than among customers who used no digital tools in the claims process.

- Many customers find themselves in hybrid digital limbo: While customers who have adopted fully digital channels experience shorter cycle times—and among whom overall satisfaction is higher, the opposite is true for those who have a partial digital/offline customer experience. Satisfaction scores are 47 points lower when customers submit photos but still need to arrange for an in-person inspection. Not only does this slow down the process, but those customers are more likely to say the process was more complicated than expected and that they experienced more process touch points.

Study Ranking

Amica Mutual and The Hartford rank highest in a tie in property insurance claims experience, each with a score of 886. Farmers (884) ranks third.

The U.S. Property Claims Satisfaction Study measures satisfaction with the property claims experience among insurance customers who have filed a claim for damages by examining five factors (listed in order of importance): settlement; claim servicing; FNOL; estimation process; and repair process. The study is based on responses from 5,724 homeowner insurance customers who filed a claim within the previous nine months. The study was fielded from April through December 2021.

For more information about the U.S. Property Claims Satisfaction Study, visit https://www.jdpower.com/business/resource/us-property-claims-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2022013.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20220228005211/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com