2023 First Quarter Financial Highlights:

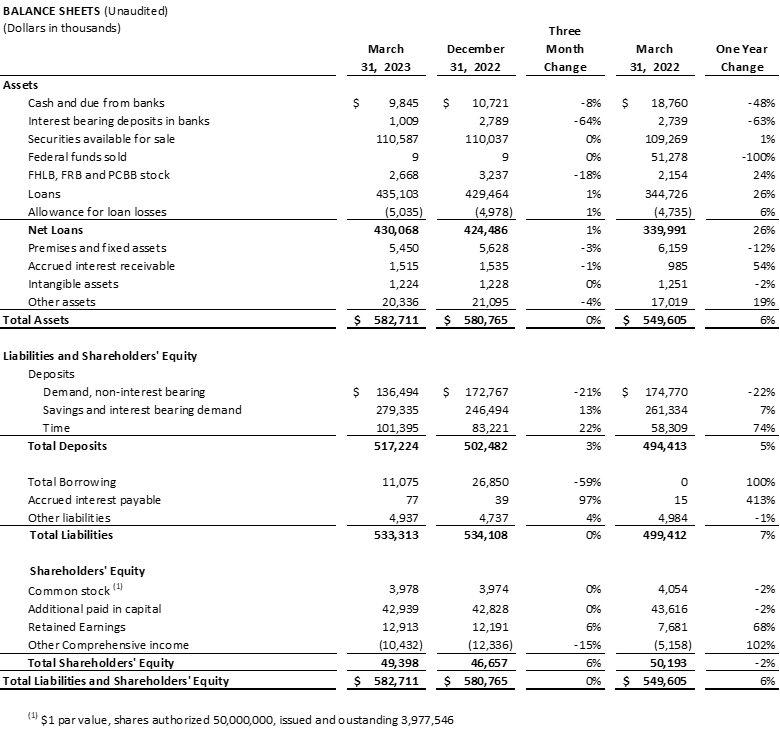

- Total assets grew to $582.7 million, or 6%, compared to one year prior.

- Loans grew by 26% from prior year, representing the 4th consecutive increase in quarterly loan balances.

- Total deposits increased 3% compared to year-end 2022 and 5% compared to first quarter 2022.

- Interest income was strong at $6 million, with a 45% increase year-over-year.

- Non-interest income increased 38% compared to first quarter 2022.

- Capital remained strong with a 9.95% leverage ratio and 14.16% total capital ratio. All capital ratios were above well-capitalized regulatory requirements.

- Welcomed a new commercial banking team previously with Columbia Bank.

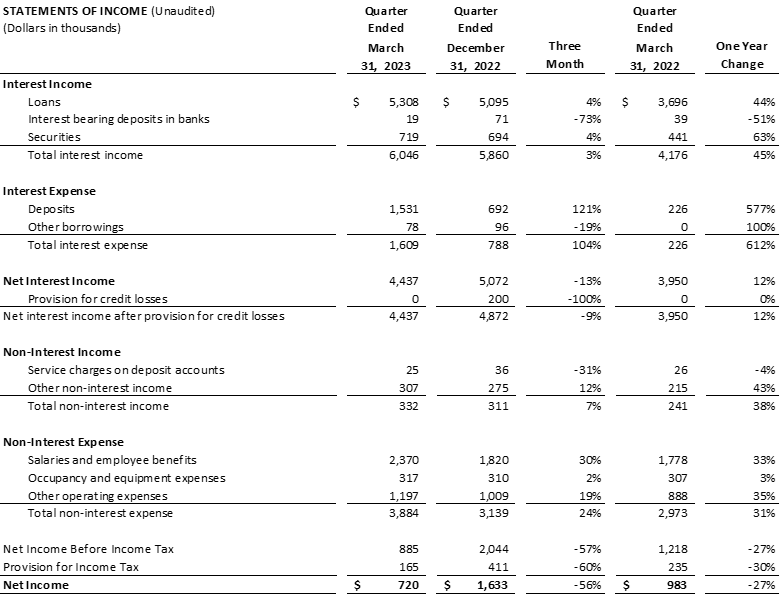

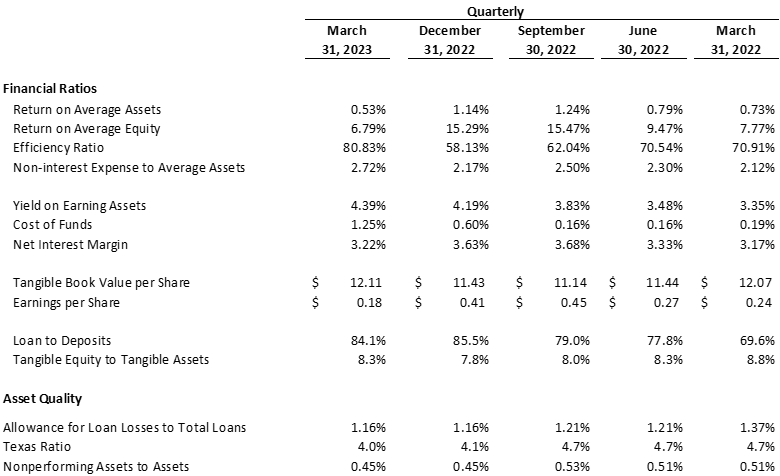

TACOMA, WA / ACCESSWIRE / May 5, 2023 / Commencement Bancorp, Inc. (OTCQX:CBWA) reported quarterly net income of $720 thousand, or $0.18 per share, for the quarter ending March 31, 2023, compared to $983 thousand and $0.24 per share for first quarter 2022. First quarter 2023, recorded net interest income, after provisions for credit losses, of $4.4 million. This represents an increase of 12% compared to one year prior.

Total assets ended the quarter at $582.7 million, an increase of 6% from first quarter 2022. Total loan balances were $435.1 million at quarter end, an increase of 26% compared to first quarter 2022, and a record in loan growth year-over-year. Total deposits increased 5%, to $517.2 million, compared to first quarter 2022. While 5% growth appears modest, first quarter deposit growth and retention were difficult for the banking industry due to the fallout from bank failures in California and New York. Banks across the country were challenged with retaining deposits, especially community-based banks, as media surrounding the incidents caused fear that smaller institutions were not as protected as larger banks. The Bank's staff was diligent with client outreach and retention efforts, minimizing the impact to the deposit portfolio.

In response to the liquidity circumstances that the banking industry faced last quarter, depositors across the country were in search of security for their funds, especially beyond the standard Federal Deposit Insurance Corporation (FDIC) insurance limit. Commencement experienced a shift in deposit mix due to the public response; therefore, funds were re-allocated from demand deposit products into interest bearing products that offer additional FDIC insurance. Interest expense recognized a notable increase due to this; however, total deposits were sustained and experienced a slight increase.

The Federal Open Market Committee (FOMC) raised rates twice during first quarter. This, alongside the recent bank failures, increased the already elevated deposit competition. Due to retention and modest growth in the deposit portfolio, the Bank's liquidity position improved, which led to a reduction in borrowings and higher cost funding compared to year-end. Liquidity was sufficient, with access to external, federally-backed funding lines available.

New client relationships continued to expand during first quarter resulting from the strong efforts made by our bankers to not only retain but grow the Bank's client base. Staff additions and the marketing strategy over the past six months were centered around the opportunities resulting from the merger of Columbia Bank into Portland, Oregon-based Umpqua Bank. This transition left Commencement as the largest community bank headquartered in Pierce County. The added salary and benefit expense caused an increase in non-interest expense and is anticipated to remain elevated while production ramps.

"I am extremely proud of the efforts of our team, which helped reaffirm our clients' confidence in our bank and industry as a whole. Our bankers put the needs and financial security of our clients first, which is at the forefront of who we are. The increase in interest expense is a direct result of defending deposits and providing clients with additional FDIC insurance through a variety of interest-bearing products. The increase in operating expenses from personnel additions, alongside the increase in marketing efforts, were a calculated investment equivalent to their anticipated return. We are proud to be one of the last community banks in Pierce County," said John Manolides, Chief Executive Officer.

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Thomas L. Dhamers, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank (WA)

View source version on accesswire.com:

https://www.accesswire.com/753189/Commencement-Bancorp-Inc-CBWA-Announces-2023-First-Quarter-Earnings