PHOENIX, AZ / ACCESSWIRE / November 10, 2022 / Crexendo, Inc. (NASDAQ:CXDO) is an award-winning premier provider of Unified Communications as a Service (UCaaS), Call Center as a Service (CCaaS), communication platform software solutions, and collaboration services with video designed to provide enterprise-class cloud communication solutions to any size business through our business partners, software licensees, agents and direct channels. Our solutions currently support over 2.5 million end users globally and was recently recognized as the fastest growing UCaaS platform in the United States. We provide our services through two divisions, our Telecommunications Division and our Software Division. Today, the Company reported financial results for the third quarter ended September 30, 2022.

Third Quarter Financial highlights:

- Total revenue increased 3% year-over-year to $9.1 million.

- GAAP net loss of $(696,000) or a $(0.03) loss per basic and diluted common share.

- Non-GAAP net income of $713,000 or $0.03 per basic and diluted common share.

Financial Results for the Third quarter of 2022

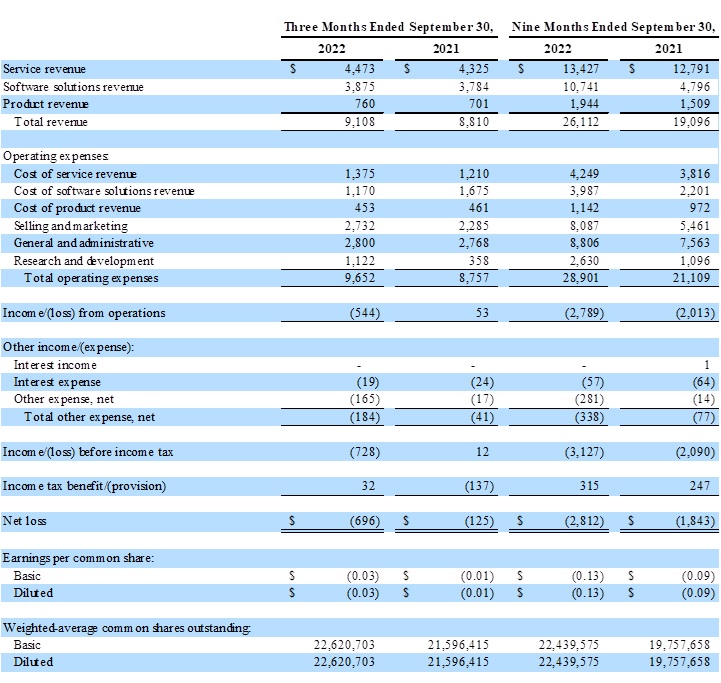

Consolidated total revenue for the third quarter of 2022 increased 3% to $9.1 million compared to $8.8 million for the third quarter of 2021.

Consolidated service revenue for the third quarter of 2022 increased 3% to $4.5 million compared to $4.3 million for the third quarter of 2021.

Consolidated software solutions revenue for the third quarter of 2022 increased 2% to $3.9 million compared to $3.8 million for the third quarter of 2021.

Consolidated product revenue for the third quarter of 2022 increased 8% to $760,000 compared to $701,000 for the third quarter of 2021.

Consolidated operating expenses for the third quarter of 2022 increased 10% to $9.7 million compared to $8.8 million for the third quarter of 2021.

The Company reported a net loss of $(696,000) for the third quarter of 2022, or a $(0.03) loss per basic and diluted common share, compared to a net loss of $(125,000), or $(0.01) loss per basic and diluted common share for the third quarter of 2021.

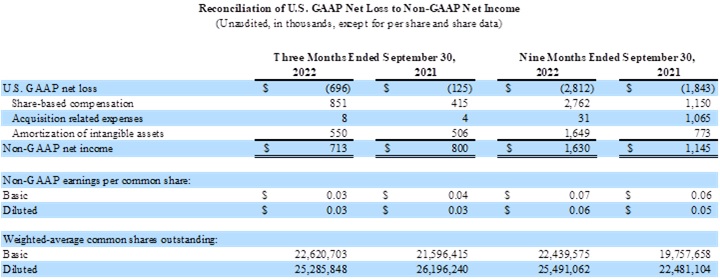

Non-GAAP net income of $713,000 for the third quarter of 2022, or $0.03 per basic and diluted common share, compared to non-GAAP net income of $800,000 or $0.04 per basic common share and $0.03 diluted common share for the third quarter of 2021.

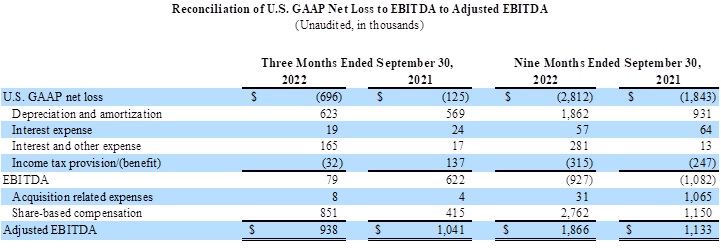

EBITDA for the third quarter of 2022 of $79,000, compared to $622,000 for the third quarter of 2021. Adjusted EBITDA for the third quarter of 2022 of $938,000, compared to $1.0 million for the third quarter of 2021.

Financial Results for the nine months ended September 30, 2022

Consolidated total revenue for the nine months ended September 30, 2022 increased 37% to $26.1 million compared to $19.1 million for the nine months ended September 30, 2021.

Consolidated service revenue for the nine months ended September 30, 2022 increased 5% to $13.4 million compared to $12.8 million for the nine months ended September 30, 2021.

Consolidated software solutions revenue for the nine months ended September 30, 2022 increased 124% to $10.7 million compared to $4.8 million for the nine months ended September 30, 2021. For comparison purposes, the nine months ended September 30, 2021 only includes four months of activity from our June 1, 2021 acquisition of the software solutions segment.

Consolidated product revenue for the nine months ended September 30, 2022 increased 29% to $1.9 million compared to $1.5 million for the nine months ended September 30, 2021.

Consolidated operating expenses for the nine months ended September 30, 2022 increased 37% to $28.9 million compared to $21.1 million for the nine months ended September 30, 2021. For comparison purposes, the nine months ended September 30, 2021 only includes four months of operating expenses from our June 1, 2021 acquisition of the software solutions segment.

The Company reported net loss of $(2.8) million for the nine months ended September 30, 2022, or $(0.13) loss per basic and diluted common share, compared to net loss of $(1.8) million, or $(0.09) loss per basic and diluted common share for the nine months ended September 30, 2021.

Non-GAAP net income of $1.6 million for the nine months ended September 30, 2022, or $0.07 per basic common share and $0.06 per diluted common share, compared to non-GAAP net income of $1.1 million or $0.06 per basic common share and $0.05 per diluted common share for the nine months ended September 30, 2021.

EBITDA loss for the nine months ended September 30, 2022 of $(927,000), compared to a loss of $(1.1) million for the nine months ended September 30, 2021. Adjusted EBITDA for the nine months ended September 30, 2022 of $1.9 million, compared to $1.1 million for the nine months ended September 30, 2021.

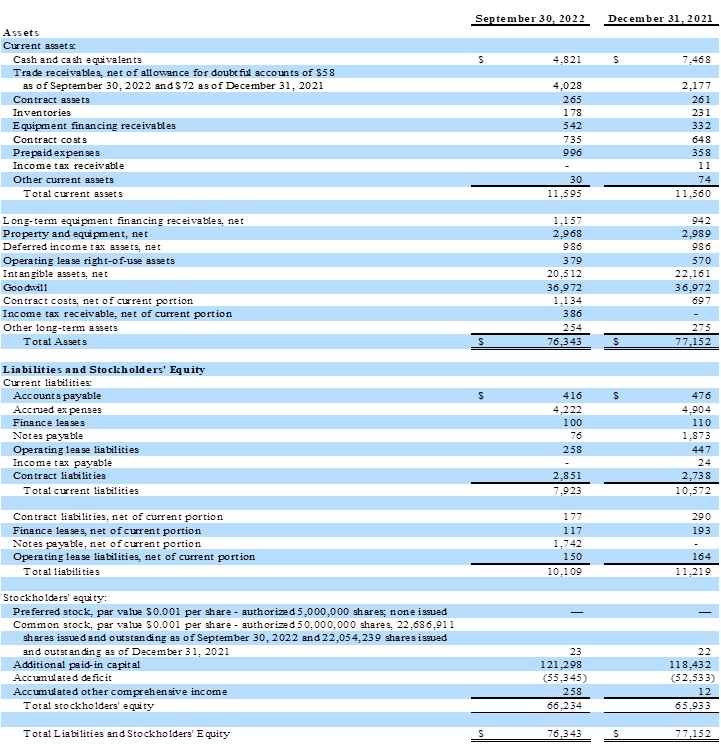

Total cash and cash equivalents at September 30, 2022 was $4.8 million compared to $7.5 million at December 31, 2021.

Cash used for operating activities for the nine months ended September 30, 2022 of $(2.7) million compared to $(473,000) used for the nine months ended September 30, 2021. Cash used for investing activities for the nine months ended September 30, 2022 of $(192,000) compared to $(10.6) million used for the nine months ended September 30, 2021. Cash used for financing activities for the nine months ended September 30, 2022 of $(36,000) compared to cash provided by investing activities of $1.1 million for the nine months ended September 30, 2021.

Steven G. Mihaylo, Chief Executive Officer commented, "I am very pleased with our results, the results give us much to be excited about. This quarter we reached a very important milestone as we exceeded nine million dollars in revenue, which is a high-water mark for us, I am convinced that is only the beginning of additional impressive milestones. We have closed the acquisition of Allegiant Networks, which is a very strong telecom company that provides many advantages to us including providing a substantial presence in the mid-west. The acquisition of Allegiant is a continuation of our growth strategy and will make an instant impact as I know the acquisition is highly accretive. In addition, the acquisition of Allegiant is very important as they were acquired from the Crexendo "fishing pond" which is our description of our base of over 200+ software solution licensees. Allegiant is currently one of our licensees on our platform and already has customers on the Crexendo platform and we will benefit from migrating those that are not on our platform over to Crexendo. That migration will have the dual benefit of providing additional benefits and support to the customers and increasing our margins. Allegiant has incredible products and services, including being a Managed Service Provider (MSP), which expands substantially the Crexendo offerings and opens up additional sales opportunities for all of our locations. With the acquisition we also add additional data centers providing additional redundancy, security, and reliability to Crexendo customers. Perhaps most importantly we have acquired a remarkable staff led by Bryan Dancer, who I have known for over 20 years and who shares the Crexendo commitment to providing our customers with the best products and services that are available anywhere. Finally, we made the acquisition without mortgaging the future of Crexendo, the only debt acquired is a small note that we expect will be paid out of profits from the acquisition. The acquisition is a huge win for us, our shareholders, and our customers"

Mihaylo added "We continue to grow the business. I was encouraged with Non-GAAP net income of $713,000 or $0.03 per basic and diluted common share, which shows we are managing the business effectively. This is even more impressive considering the substantial economic uncertainty and headwinds that everyone is facing. I am convinced we will continue to have positive cash flow to grow the business and that our customer base will continue to grow both in the software solution division and service division. With that said, we are working to increase the average sale and the size of our customers. We are working to hone marketing into those larger mid-size and enterprise markets. I am convinced we will grow sales and profits. We will also continue to look for accretive acquisitions on terms that don't cause substantial debt. We will continue to watch every penny we spend and continue to increase shareholder value. I am very proud of our results and very proud of our team."

Doug Gaylor, President, and Chief Operating Officer stated "I too am encouraged with our Q3 results. I am very excited about the Allegiant acquisition and working with the Allegiant team on growing our business organically. The closing of Allegiant is just one of the many steps we have taken in continuing to fulfill our plan. What we have done in a short time is remarkable, we were able to make the business steadily Non-GAAP profitable, able to organically up list to the Nasdaq exchange, able to accomplish a major transformation acquisition in NetSapiens and able to access the Crexendo fishing pond with another accretive acquisition while growing the business organically. The acquisition of Allegiant is a win-win for all parties including the Allegiant customers, our employees, and most importantly our shareholders. We will not rest on the success of this quarter, we will continue to perform, we will work on Steve's initiatives of sales and marketing, and I am convinced substantially grow the business."

Conference Call

The Company is hosting a conference call today, November 10, 2022, at 4:30 PM EST. The dial-in number for domestic participants is 844-369-8770 and 862-298-0840 for international participants. Please dial in five minutes prior to the beginning of the call at 4:30 PM EST and reference participant access code Crexendo. A replay of the call will be available until November 17, 2022, by dialing toll-free at 877-481-4010 or 919-882-2331 for international callers. The replay passcode is 47050.

About Crexendo

Crexendo, Inc. is an award-winning premier provider of Unified Communications as a Service (UCaaS), Call Center as a Service (CCaaS), communication platform software solutions, video conferencing and collaboration services with video designed to provide enterprise-class cloud communication solutions to any size business through our business partners, agents, and direct channels. Our solutions currently support over 2.5 million end users globally and was recently recognized as the fastest growing UCaaS platform in the United States.

Safe Harbor Statement

This press release contains forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for such forward-looking statements. The words "believe," "expect," "anticipate," "estimate," "will" and other similar statements of expectation identify forward-looking statements. Specific forward-looking statements in this press release include information about Crexendo (i) being very pleased with the results and the results being the beginning of additional impressive milestones; (ii) believing the acquisition of Allegiant Networks providing many advantages; the acquisition being highly accretive; (iii) believing the acquisition of Allegiant being very important as they were acquired from the Crexendo "fishing pond"; (iv) believing that migrating acquired customers to the Crexendo platform will have the dual benefit of providing additional benefits and support to the customers and increasing margins; (v) Allegiant expanding substantially the Crexendo offerings and opening up additional sales opportunities;.(vi) adding additional redundancy, security, and reliability to Crexendo customers; (vii) making the acquisition without mortgaging the future and that the only debt acquired is a small note that is expected to be paid out of profits from the acquisition; (vii) believing it is managing the business effectively; (viii) believing it will continue to have positive cash flow to grow the business and that its customer base will continue to grow both in the software solution division and service division; (ix) working to increase the average sale of customers and honing marketing into those larger mid-size and enterprise markets; (x) being convinced it will grow sales and profits; (xi) looking for accretive acquisitions on terms that don't cause substantial debt; (xii) continuing to watch every penny spent and continue to increase shareholder value; (xiii) growing the business organically; (xiv) continuing to fulfill its plan; (xv) believing that acquisition of Allegiant is a win-win for all parties including the Allegiant customers, its employees, and shareholders; (xvi) not resting on the success of this quarter and continuing to perform while working on initiatives of sales and marketing and substantially grow the business.

For a more detailed discussion of risk factors that may affect Crexendo's operations and results, please refer to the company's Form 10-K for the year ended December 31, 2021, and quarterly Form 10-Qs as filed with the SEC. These forward-looking statements speak only as of the date on which such statements are made, and the company undertakes no obligation to update such forward-looking statements, except as required by law.

Contact

Crexendo, Inc.

Doug Gaylor

President and Chief Operating Officer

602-732-7990

dgaylor@crexendo.com

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except par value and share data)

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share and share data)

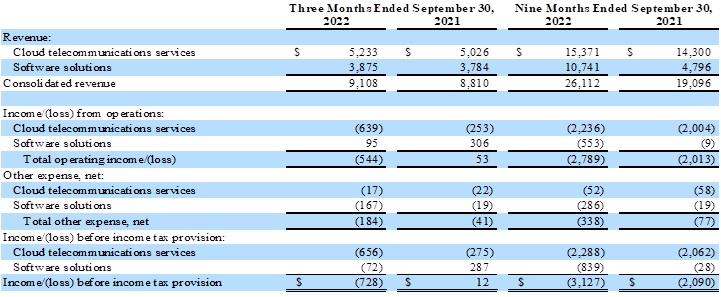

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

CREXENDO, INC. AND SUBSIDIARIES

Supplemental Segment Financial Data

(In thousands)

Use of Non-GAAP Financial Measures

To evaluate our business, we consider and use non-generally accepted accounting principles ("Non-GAAP") net income and Adjusted EBITDA as a supplemental measure of operating performance. These measures include the same adjustments that management takes into account when it reviews and assesses operating performance on a period-to-period basis. We consider Non-GAAP net income to be an important indicator of overall business performance because it allows us to evaluate results without the effects of share-based compensation, acquisition related expenses, changes in fair value of contingent consideration and amortization of intangibles. We define EBITDA as U.S. GAAP net income/(loss) before interest income, interest expense, other income and expense, provision for income taxes, and depreciation and amortization. We believe EBITDA provides a useful metric to investors to compare us with other companies within our industry and across industries. We define Adjusted EBITDA as EBITDA adjusted for acquisition related expenses, changes in fair value of contingent consideration and share-based compensation. We use Adjusted EBITDA as a supplemental measure to review and assess operating performance. We also believe use of Adjusted EBITDA facilitates investors' use of operating performance comparisons from period to period, as well as across companies.

In our November 10, 2022, earnings press release, as furnished on Form 8-K, we included Non-GAAP net income, EBITDA and Adjusted EBITDA. The terms Non-GAAP net income, EBITDA, and Adjusted EBITDA are not defined under U.S. GAAP, and are not measures of operating income, operating performance or liquidity presented in analytical tools, and when assessing our operating performance, Non-GAAP net income, EBITDA, and Adjusted EBITDA should not be considered in isolation, or as a substitute for net income/(loss) or other consolidated income statement data prepared in accordance with U.S. GAAP. Some of these limitations include, but are not limited to:

- EBITDA and Adjusted EBITDA do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- they do not reflect changes in, or cash requirements for, our working capital needs;

- they do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt that we may incur;

- they do not reflect income taxes or the cash requirements for any tax payments;

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will be replaced sometime in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements;

- while share-based compensation is a component of operating expense, the impact on our financial statements compared to other companies can vary significantly due to such factors as the assumed life of the options and the assumed volatility of our common stock; and

- other companies may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

We compensate for these limitations by relying primarily on our U.S. GAAP results and using Non-GAAP net income, EBITDA, and Adjusted EBITDA only as supplemental support for management's analysis of business performance. Non-GAAP net income, EBITDA and Adjusted EBITDA are calculated as follows for the periods presented.

Reconciliation of Non-GAAP Financial Measures

In accordance with the requirements of Regulation G issued by the SEC, we are presenting the most directly comparable U.S. GAAP financial measures and reconciling the unaudited Non-GAAP financial metrics to the comparable U.S. GAAP measures.

SOURCE: Crexendo, Inc.

View source version on accesswire.com:

https://www.accesswire.com/724887/Crexendo-Announces-Third-Quarter-2022-Results